A good accounting client intake form does two things: it collects the right information from new clients before any work begins, and it sets the tone for a professional, organized relationship. Without one, firms spend the first weeks of every engagement chasing missing details through scattered emails and phone calls — often while filing deadlines are already approaching.

This template includes 25+ accounting intake questions organized by category, differences between tax and audit client intake, and a walkthrough of how to send your form to clients. Copy the questions that fit your practice and adapt the rest.

Why Accounting Firms Need a Structured Intake Form

Every new client engagement starts the same way: you need their information before you can do any work. The question is whether you collect it in a structured, repeatable way — or through a scattered series of emails, phone calls, and follow-ups that eat into billable time.

A structured intake form solves three problems at once:

- Fewer follow-ups. Asking the right questions upfront means you rarely need to go back for missing information. One form replaces what would otherwise become five or six separate emails.

- Faster onboarding. When you have the client's entity type, tax history, and financial setup from day one, your team can start work immediately instead of waiting for answers to trickle in.

- Consistent quality. Every new client goes through the same intake process. Junior staff collect the same information as senior partners, and nothing gets missed because someone forgot to ask.

The rest of this guide gives you the actual questions to include — organized by the categories that matter most for accounting and bookkeeping engagements.

Personal and Contact Information

Start with the basics. These details identify the client, establish how to reach them, and provide the information your practice management software needs from day one.

- Full legal name (individual or business owner)

- Preferred name or nickname

- Date of birth

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Current mailing address

- Phone number (cell and work)

- Email address

- Preferred contact method (email, phone, or text)

- Marital status

- Spouse's full legal name and SSN (if filing jointly)

- Number of dependents (names, dates of birth, SSNs)

Collect the spouse's information during intake even if the client says they file separately. Filing status can change, and having the information on file prevents delays if they decide to file jointly later.

Business Information and Entity Details

For business clients, entity structure determines everything from which tax forms you file to how income is allocated. These questions establish the fundamentals of the engagement.

- Legal business name (and any DBAs or trade names)

- Employer Identification Number (EIN)

- Business entity type (sole proprietorship, single-member LLC, multi-member LLC, S-Corp, C-Corp, partnership, nonprofit)

- State of incorporation or formation

- Date the business was established

- Business address (if different from mailing address)

- Industry or primary business activity

- NAICS code (if known)

- Number of employees (full-time and part-time)

- Fiscal year end date

- States where the business has nexus or filing obligations

- Names, titles, and ownership percentages of all owners, partners, or officers

Pay attention to the entity type and state nexus answers. An LLC taxed as an S-Corp has different filing requirements than a standard LLC, and multi-state nexus significantly increases the scope of work. These two answers often determine whether your initial fee estimate holds or needs revision.

Tax History and Filing Status

A client's tax history is where problems hide. Unfiled returns, outstanding balances with the IRS, or unresolved state notices can derail an engagement if you discover them after work has already started. These questions surface those issues early.

- Tax filing status (single, married filing jointly, married filing separately, head of household, qualifying surviving spouse)

- Have you filed all required federal and state tax returns for the past three years?

- Who prepared your previous tax returns? (self-prepared, another CPA firm, tax preparer, software)

- Do you have copies of your last two to three years of federal and state tax returns?

- Have you received any IRS or state tax notices, audits, or collection letters?

- Do you have any outstanding tax balances or active payment plans?

- Have you filed for any extensions in recent years?

- Have you made estimated tax payments this year? If so, what amounts and dates?

Clients switching from another firm may not always have copies of prior returns. Ask early so you have time to request transcripts from the IRS (Form 4506-T) or obtain files from the previous preparer before deadlines arrive. For a complete list of tax documents to collect, see our tax return checklist for clients.

Current Financial Setup

These questions reveal how the client currently manages their finances — what software they use, how their accounts are structured, and whether their records are clean or need rebuilding. The answers directly affect how much setup your team needs to do and how you scope the engagement.

- What accounting or bookkeeping software do you use? (QuickBooks Online, QuickBooks Desktop, Xero, FreshBooks, Wave, spreadsheets, none)

- Who currently manages your day-to-day bookkeeping? (yourself, in-house bookkeeper, outsourced bookkeeper, no one)

- How many bank accounts does the business use?

- How many credit cards does the business use?

- Do you have a separate business bank account from personal?

- Do you use a payroll provider? If so, which one? (ADP, Gusto, Paychex, in-house, other)

- Do you collect sales tax? In which states?

- Do you have any outstanding loans or lines of credit?

- Do you have any current or pending lawsuits?

- Do you carry any business insurance policies? (general liability, professional liability, workers' comp)

The answer to "Do you have a separate business bank account?" reveals more than accounting structure. It signals how organized the client is and whether you will need to untangle personal and business expenses before any real work begins. Factor that into your engagement timeline.

Service Expectations and Engagement Scope

These final questions align your firm's services with what the client needs. A client who expects monthly phone calls and a partner who assumed quarterly email updates will both be disappointed — and that disconnect is preventable when you ask during intake.

- Which services are you looking for? (tax preparation, bookkeeping, payroll, tax planning, financial statements, audit preparation, advisory, other)

- How often do you expect to communicate with your accountant? (monthly, quarterly, as needed)

- Are there any immediate deadlines we should be aware of? (upcoming filing dates, IRS notices with response deadlines)

- What is your preferred method for sharing documents? (email, upload portal, in-person drop-off)

- Are there any specific financial goals you want to work toward? (reducing tax liability, preparing for a loan, preparing for sale, growth planning)

- How did you hear about our firm?

- Is there anything else we should know about your financial situation?

The open-ended question at the end catches what structured questions miss. Clients often use this space to mention a concern they were not sure how to bring up — a dispute with the IRS, commingled funds from a previous business partner, or a life event that will affect their tax situation.

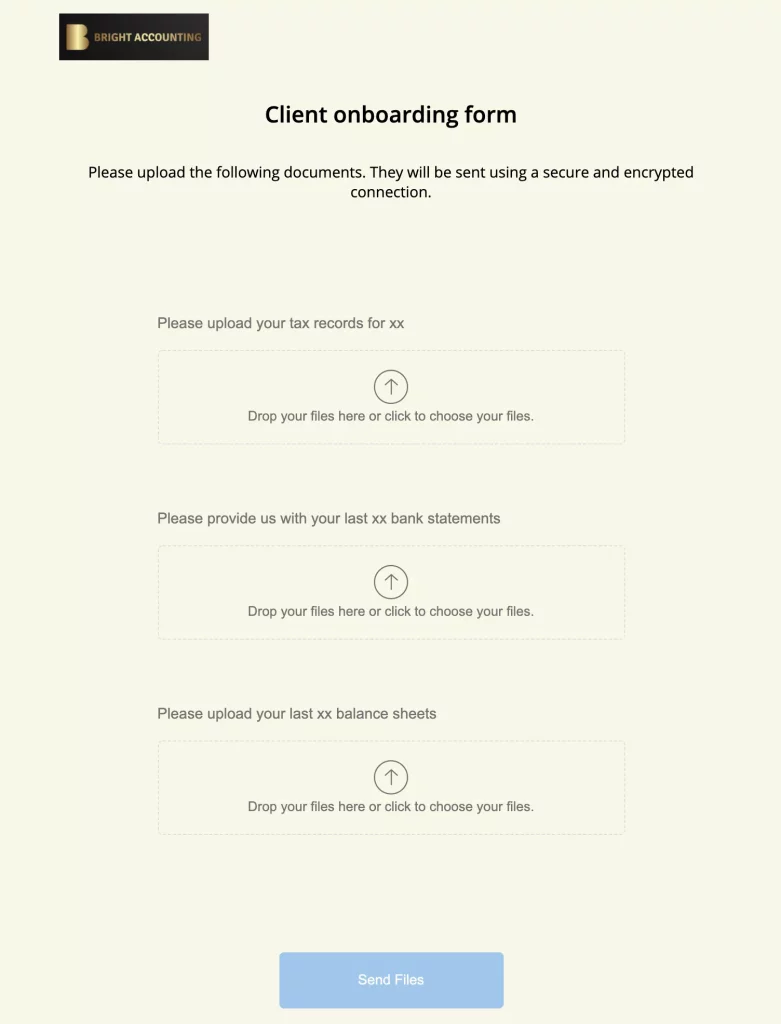

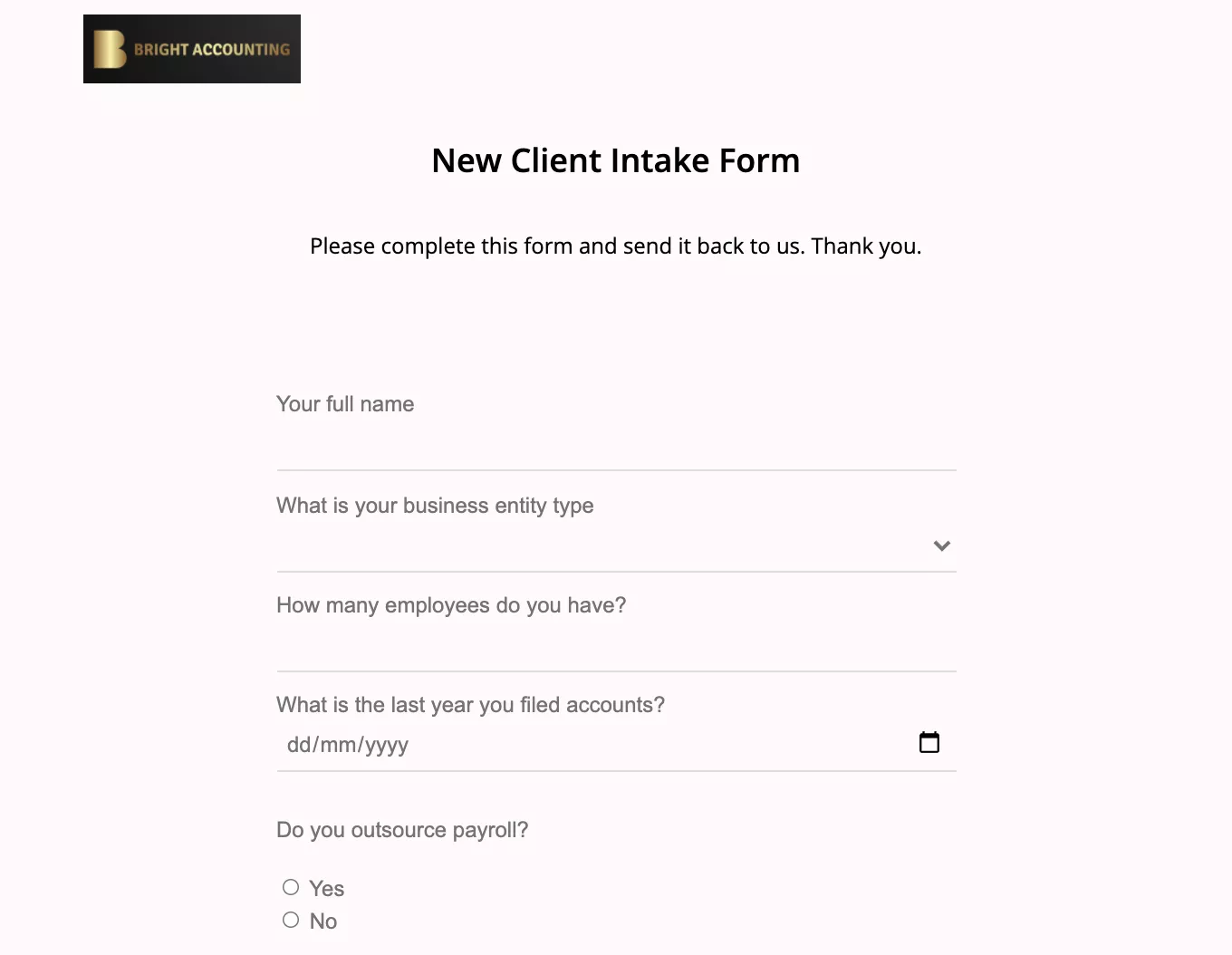

The intake forms shown in this article were created using File Request Pro, a content and document collection tool for professional services firms. See our general client intake form guide for more examples across industries.

Tax Client vs. Audit Client Intake Differences

The core intake questions above work for most accounting engagements. But tax clients and audit clients have different needs, and your intake form should reflect that. Here is what changes between the two.

Tax client intake focus

Tax clients need you to prepare and file returns accurately and on time. The intake form should emphasize:

- Filing status and dependents — these directly determine the return type and available credits

- Income sources — W-2 employment, 1099 contract work, rental income, investment income, business income

- Deductions and credits — mortgage interest, charitable contributions, education expenses, child care expenses, retirement contributions

- Estimated payments — amounts and dates of quarterly payments already made

- Prior year carryforwards — capital loss carryovers, net operating losses, unused credits

- State filing requirements — states where the client lived, worked, or earned income during the year

For tax clients, the intake form often doubles as a document request. You are not just asking questions — you need them to upload W-2s, 1099s, mortgage statements, and other supporting documents alongside their answers.

Audit client intake focus

Audit clients need you to examine their financial statements and issue an opinion. The intake shifts toward:

- Financial statement framework — GAAP, IFRS, cash basis, or other applicable framework

- Prior audit history — previous auditor, type of opinion issued, any material weaknesses or findings

- Internal controls — how the client authorizes transactions, separates duties, and safeguards assets

- Related party transactions — dealings with owners, family members, affiliated entities

- Regulatory requirements — government audit requirements, grant compliance, industry-specific regulations

- Litigation and contingencies — pending or threatened lawsuits, guarantees, potential liabilities

Audit intake forms also tend to request access to systems rather than documents. You need login credentials for the accounting software, bank portals for confirmation requests, and communication channels with the client's legal counsel.

Adapting one form for both

You don't need two completely separate intake forms. Start with the core questions (personal information, business details, financial setup) and use conditional sections. If the client selects "tax preparation" as their service, show the tax-specific questions. If they select "audit" or "assurance," show the audit-specific section. This keeps the form relevant without overwhelming the client with questions that do not apply to their engagement.

How to Send Your Accounting Intake Form

A thorough intake form only works if clients complete it. The delivery method matters as much as the questions themselves — a well-structured form sent the wrong way still produces half-completed responses and the same follow-up emails you were trying to eliminate.

Option 1: Email with an attached document

Emailing a Word document or PDF is simple to set up. The client downloads it, fills it in, and emails it back. This works for small firms with a handful of new clients per month, but has clear limitations. Clients struggle with formatting in Word documents. Sensitive information (SSNs, EINs) travels over unencrypted email. And when you also need documents alongside the form responses — prior tax returns, bank statements, formation documents — email attachments become unmanageable fast.

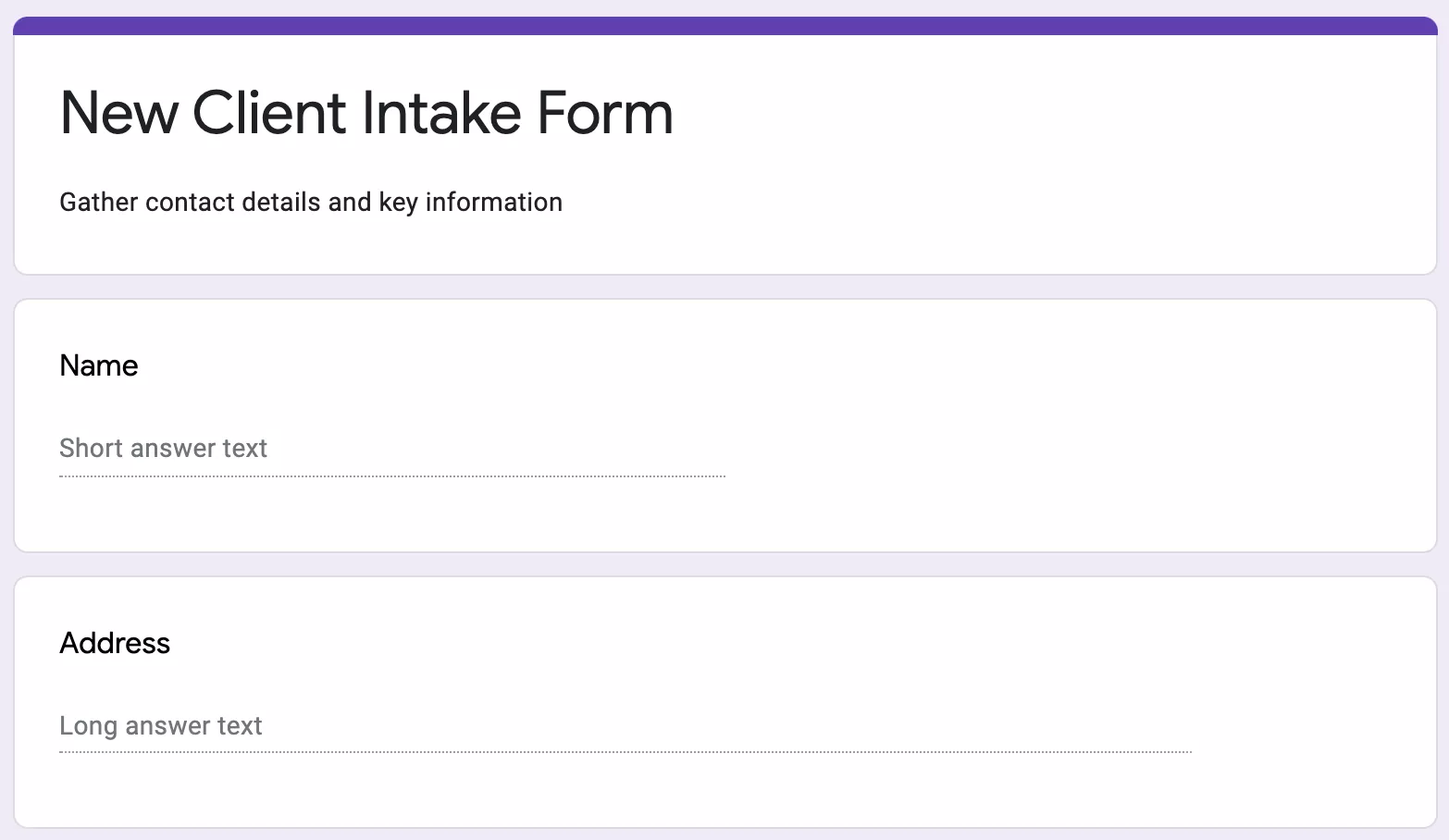

Option 2: Online form builder

Google Forms, Typeform, or JotForm let you build an online intake form that clients fill out in their browser. Responses flow into a spreadsheet. This improves the client experience and eliminates formatting issues. The limitation is file collection: most form builders either do not support file uploads, impose tight size limits, or store uploaded files in disorganized locations separate from the form responses.

Option 3: Dedicated document collection tool

A purpose-built tool like File Request Pro combines the intake form and document collection into a single branded page. You list every question and every document you need — organized by category — and clients work through it at their own pace.

This approach solves the specific problems accounting firms face during intake:

- Form fields and file uploads in one place. Clients answer your intake questions and upload tax returns, bank statements, and formation documents in the same session. No separate emails. No "I'll send that later."

- No client login required. Clients open the link, complete the form, upload files, and submit. No accounts to create, no passwords to remember.

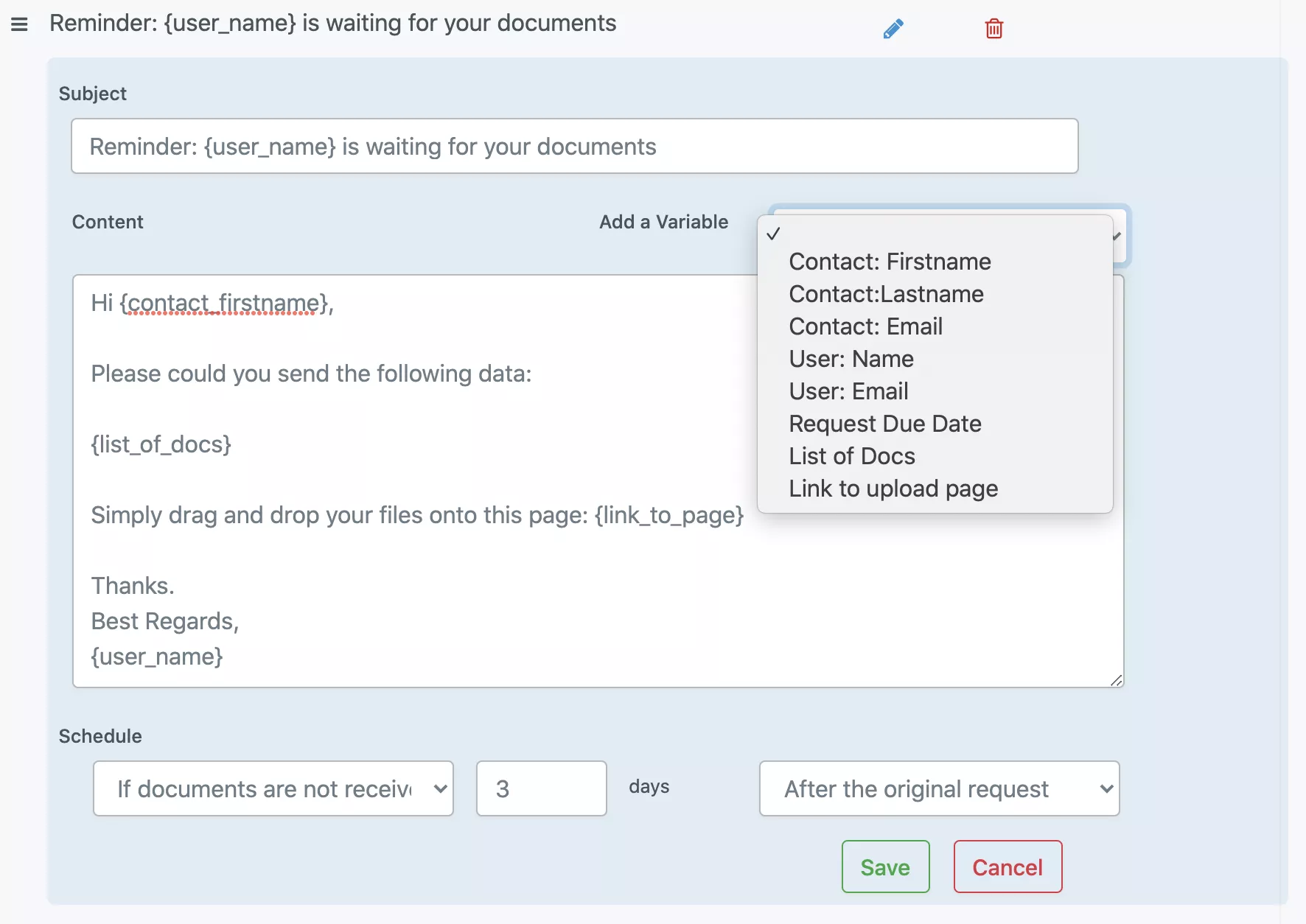

- Automatic reminders. Clients who have not completed the form receive follow-up emails on a schedule you set. You stop chasing and start receiving.

- Cloud storage integration. Submitted files route directly to Google Drive, OneDrive, SharePoint, or Dropbox — organized by client name or any field you choose.

- Conditional logic. Show tax-specific questions to tax clients and audit-specific questions to audit clients. Sole proprietors see a shorter form than S-Corp owners with payroll. Each client only sees what is relevant to them.

- Branded experience. The upload page carries your firm's logo and colors, reinforcing the professional image you want to project from the first interaction.

For firms handling multiple new client engagements during busy season, the combination of automated reminders and organized file storage pays for itself in hours saved during the first week alone.

Tips for Getting Better Intake Form Responses

Even a well-designed form can fall flat if the delivery and follow-up are not handled well. These practices help you get complete, accurate responses from new clients.

Explain why you need each piece of information

Clients hesitate when asked for sensitive details — Social Security Numbers, bank account information, prior tax balances — without understanding why. A short note next to each section ("Required for tax filing" or "Needed to set up your accounting software access") reduces friction and builds trust.

Group questions by category

A 30-question form feels overwhelming. The same 30 questions split into five labeled sections — Personal Information, Business Details, Tax History, Financial Setup, Service Expectations — feels manageable. Clients can work through one section at a time without losing their place.

Set a specific deadline

"Please complete at your earliest convenience" produces slow responses. "Please complete by March 1 so we can begin your return before the April deadline" produces action. Tie the deadline to a real consequence the client cares about.

Send the form before the first meeting

If you send the intake form after the initial consultation, clients have already mentally checked the box on "getting started." The form feels like homework. If you send it before the meeting, the consultation itself becomes more productive — you already have the basics and can focus on strategy rather than data collection.

Follow up once, then automate

One personal follow-up email at the three-day mark shows you care. After that, automated reminders at seven and fourteen days keep the process moving without adding to your workload. Most clients are not ignoring you — they are busy. A well-timed nudge is all it takes.

Frequently Asked Questions

What should an accounting client intake form include?

A complete accounting intake form covers personal and contact information, business entity details (legal name, EIN, entity type, state registrations), tax history and filing status, current financial setup (accounting software, bank accounts, bookkeeping method), and service expectations. For business clients, also include ownership details, employee count, and multi-state filing obligations. The specific questions depend on whether the engagement involves tax preparation, bookkeeping, audit, or advisory services.

What is the difference between an accounting intake form and a bookkeeping intake form?

An accounting intake form covers the full range of services — tax preparation, planning, financial statements, and advisory work. It typically asks about tax history, filing status, deductions, and prior returns. A bookkeeping intake form focuses more narrowly on financial recordkeeping: which accounting software the client uses, how many bank and credit card accounts need reconciliation, current expense tracking methods, and the state of existing financial records. Many firms combine both into a single intake form with conditional sections.

How many questions should an accounting intake form have?

Most effective intake forms include 25 to 40 questions, depending on the services offered and client type. The key is relevance, not length. A sole proprietor with a simple tax return should not answer the same 40 questions as a multi-member LLC with payroll and multi-state nexus. Use conditional logic to show only the questions that apply to each client's situation.

When should I send the intake form to a new client?

Send the intake form before the initial consultation whenever possible. This gives clients time to gather information and documents, and it makes the first meeting more productive — you can discuss strategy instead of collecting basic data. If the client reaches out during tax season with an urgent deadline, send the form immediately after the first phone call with a clear submission date.

How do I handle sensitive information like Social Security Numbers on an intake form?

Never collect SSNs, EINs, or bank account details over unencrypted email. Use a secure online form with SSL encryption, or a document collection tool that stores data in encrypted cloud storage with access controls. Explain to clients why you need the information and how it will be protected. If your firm is subject to GLBA (Gramm-Leach-Bliley Act) or IRS data security requirements, make sure your collection method meets those standards. For more on this topic, see our guide to data security in accounting.

Can I use the same intake form for individual and business clients?

Yes, if you use conditional logic. Start with a question that asks whether the client is an individual or a business. Based on their answer, show the relevant sections — business entity details, ownership structure, and payroll questions appear only for business clients, while dependent information and filing status appear for individuals. This keeps one form manageable for both client types without asking irrelevant questions.

What documents should I collect alongside the intake form?

At minimum, collect copies of the previous two to three years of federal and state tax returns, government-issued ID, EIN confirmation letter (for businesses), and any IRS or state correspondence. Depending on the engagement, you may also need bank and credit card statements, payroll records, formation documents, depreciation schedules, and prior financial statements. A tool that combines form fields and file uploads — like File Request Pro — lets clients answer questions and submit documents in a single step.

How often should I update my accounting intake form?

Review and update your intake form at least once a year, ideally before the start of tax season. Tax law changes, new IRS requirements, and changes in your firm's service offerings all affect which questions are relevant. Also update the form whenever you notice recurring follow-up questions — if you are asking the same clarifying question to multiple new clients, that question belongs on the intake form.