The digital age has revolutionized the way financial data is gathered, processed, and stored, while this transformation has brought unprecedented convenience and efficiency, it has also opened the door to new vulnerabilities, in an era where data breaches and cyberattacks are a constant threat, securely collecting information has become not just a best practice but a critical necessity for organizations in the field of accounting.

In this article, we will delve into the importance of securely collecting information in the realm of accounting, exploring the risks associated with inadequate data security and the key principles and tips for best practices.

The Significance of Secure Information Collection in Accounting

Data is the lifeblood of accounting. It serves as the foundation upon which financial decisions are made, reports are generated, and the health of an organization is assessed. In essence, accounting is the systematic process of collecting, recording, organizing, and interpreting financial data to provide insights into an entity’s financial performance and position.

Data in accounting serves as the raw material for financial reports, including balance sheets, income statements, and cash flow statements. Without accurate and comprehensive data, it would be impossible to track the flow of money in and out of an organization. The accuracy, timeliness, and security of financial data should be a top priority, as they influence the quality of financial reporting, the effectiveness of decision-making, and the overall success of an organization.

What are the consequences of insecure information collection in accounting?

The consequences of insecure information collection can be severe and far-reaching. Let’s explore some of the potential repercussions of failing to prioritize the security of data in accounting processes:

- Insecure information collection can lead to data breaches or unauthorized access, resulting in financial losses due to theft, fraud, or litigation expenses.

- Organizations may be held liable for compensating affected parties, covering regulatory fines, and bearing the cost of remediation efforts.

- A breach of financial data erodes trust and confidence in an organization. Stakeholders, including clients, investors, and partners, may lose faith in the entity’s ability to safeguard sensitive information.

- Non-compliance can result in severe penalties, fines, or even legal action brought against the organization by regulatory authorities or affected parties.

- The disruption caused by a breach can impede normal operations, leading to delays, reduced productivity, and potential loss of revenue.

- Clients and employees entrust organizations with their sensitive information. A breach of this trust can lead to a loss of client loyalty and employee morale.

- Financial repercussions, such as increased insurance premiums, diminished creditworthiness, and decreased market value, can continue to impact the organization for years.

Recognizing and addressing the importance of secure data handling practices is imperative not only for compliance with regulations or a response to potential threats; it’s a fundamental responsibility that organizations owe to their clients, partners, and themselves.

Key Principles and Tips for Securely Collecting Information in Accounting

Having recognized the importance of securely collecting information in accounting, it is imperative to delve into the practical aspects of implementation, where to star, what can we do to collect the financial documents in a way that is secure but also not too difficult that hinders the whole process. Here are some of this principles and tips to consider:

Encryption and Data Protection

At its core, encryption is the process of converting plain, readable data into a complex code or cipher, rendering it unintelligible to anyone lacking the decryption key.

Encryption, in the realm of data security, stands as an impenetrable fortress that shields sensitive information from prying eyes. It accomplishes this by converting data into an unreadable format through complex algorithms, rendering it comprehensible only to those with the authorized decryption keys. It plays a crucial role in protecting sensitive financial data in accounting, as it safeguards information both in transit and at rest.

Access Control (RBAC)

One of the fundamental pillars of securely collecting information in accounting is the implementation of robust access control measures. Access control serves as a way to ensure that sensitive financial data remains in the hands of authorized personnel while keeping unauthorized individuals at bay.

Role-based access control (RBAC) is a systematic method for managing and regulating access to data within an organization. RBAC categorizes users into roles, each of which has predefined permissions and limitations. This approach streamlines data access by assigning permissions based on job responsibilities and ensures that individuals can access only the information necessary for their role.

RBAC can be tailored to roles like “Financial Analyst,” “Accountant,” or “Auditor.” A financial analyst, for instance, might have access to budgeting and forecasting data, while an accountant would be granted permissions to manage ledgers and transaction records. By aligning access with job roles, organizations minimize the risk of unauthorized data exposure and enhance data security.

Moreover, revocation of access should be equally well-managed. When employees change roles, depart from the organization, or no longer require specific data access, their permissions should be promptly updated or revoked. Regularly reviewing and updating access privileges is vital for maintaining data security and preventing potential insider threats.

Regular Auditing and Monitoring

Proactive measures are always the best way to handle things when we are talking about keeping information secure, this is why regular auditing and monitoring come as a great action to implement, serving as the vigilant gatekeepers of an organization’s financial data.

Routine audits and monitoring can detect potential issues before they escalate, routine checks in the world of data security serve as a preemptive measure to identify vulnerabilities and irregularities in the system. These regular assessments provide a comprehensive view of the data security landscape, allowing organizations to maintain a strong defense against emerging threats and compliance issues. Moreover, periodic audits are often a regulatory requirement, especially in industries where the protection of financial data is paramount. It’s not just a matter of best practice; it’s a legal necessity that ensures the organization’s adherence to industry standards and regulations.

Employee Training and Awareness

The role of employees in maintaining data security cannot be overstated. It is not only about investing in top-tier security software and systems but also about fostering a culture of vigilance and responsibility among the workforces.

Training programs should be designed to familiarize employees with security protocol, regular workshops and updates ensure that employees remain well-versed in the latest security best practices and the evolving nature of cyber threats. Beyond training, instilling a culture of data security within the organization is crucial. Employees should understand that they play an active role in safeguarding sensitive financial information. This culture entails fostering a sense of responsibility and accountability, where everyone from the CEO to the entry-level staff is invested in maintaining the integrity and confidentiality of data.

Utilizing Secure Data Collection Tools

Secure data collection software has become indispensable for organizations seeking to safeguard sensitive financial information. The purpose of implementing a data collection tool is to build and streamline the data gathering process but also to fortify the security of this critical stage in accounting. These tools are designed with advanced security measures, encryption protocols, and access controls to protect sensitive financial data from unauthorized access and breaches.

Select the Optimal Solutions for Secure Data Collection Tools

The choice of the right tool can make the difference between safeguarding sensitive financial information and exposing an organization to significant risks. Let’s delve into some options available to empower organizations with the best tools for their data collection needs:

DocuSign:

Is a widely recognized electronic signature and document management platform, often used in accounting for secure document collection and client interactions. While primarily known for its e-signature capabilities, it also offers secure document upload and request features.

Accountants can send requests to clients to collect tax returns, financial statements, and other critical documents. Documents can be easily accessed, signed, and returned securely within the platform.

Advantages:

- Versatility: DocuSign is a comprehensive document management tool with a wide range of applications.

- Legally Binding: Documents signed using DocuSign are legally binding, which is crucial for accounting and financial processes.

- Integrations: It offers various integrations with popular accounting and CRM software, improving workflow efficiency.

Disadvantages:

- Cost: DocuSign’s full range of features can be expensive, making it less suitable for small accounting firms or individual accountants.

- Learning Curve: While user-friendly, DocuSign may have a learning curve for users new to the platform.

SmartVault:

Is a document management and secure file sharing platform designed for businesses, including accounting firms. It offers robust document collection and storage features, allowing accountants to securely collect, organize, and access critical financial documents from clients. The platform provides a secure portal for clients to upload documents, and it integrates with popular accounting software.

Advantages:

- Comprehensive Document Management: SmartVault offers features beyond document collection, including document storage, organization, and secure sharing.

- Integration: It integrates with accounting software like QuickBooks, simplifying document management within existing workflows.

- Collaboration: Accountants can collaborate with clients in a secure environment, enhancing client relationships and efficiency.

Disadvantages:

- Cost: SmartVault comes with a subscription fee, and pricing can vary based on the number of users and storage requirements.

- Complexity: The platform’s extensive features may be more complex than some smaller accounting firms require.

File Request Pro:

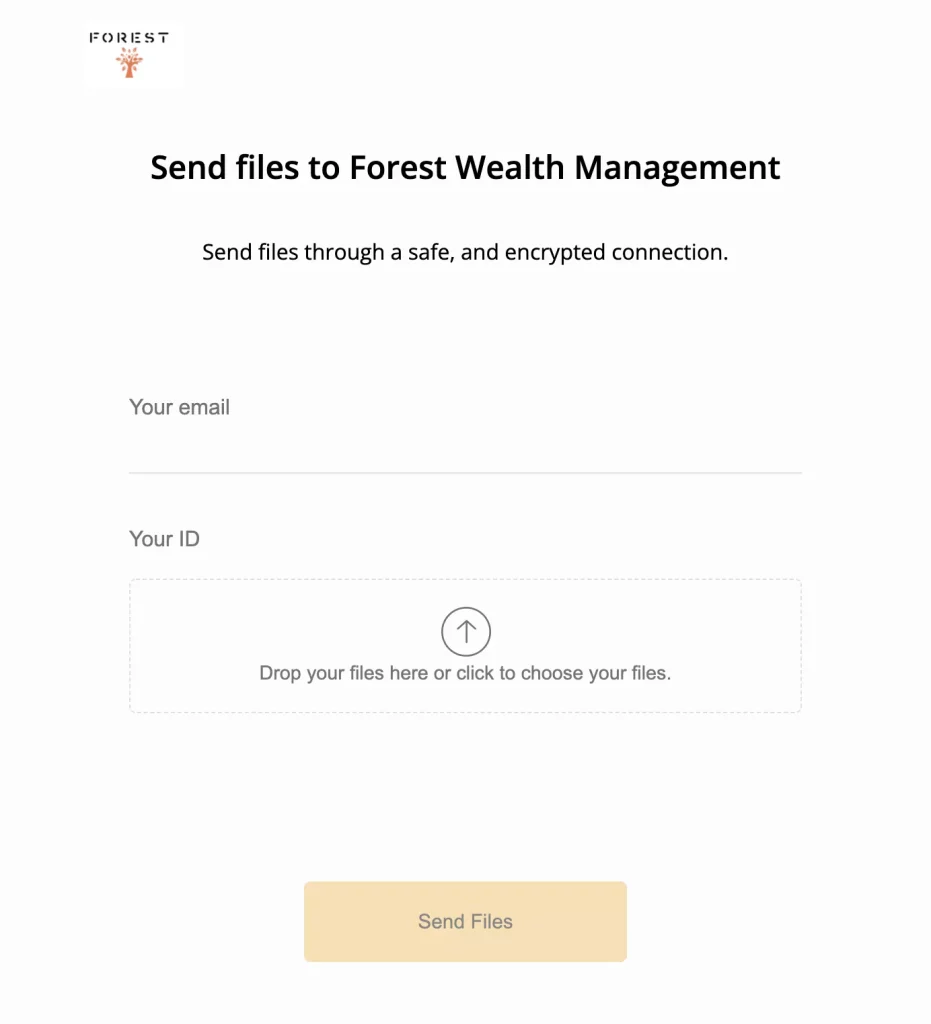

Is a specialized file request and collection tool that streamlines the process of securely collecting financial documents from clients and external stakeholders. With a user-friendly interface, it simplifies the request submission process, allowing accountants to request specific files, documents, or financial data from clients. Clients receive a link to a secure portal where they can upload the requested documents directly.

Advantages:

- Security: File Request Pro employs strong encryption to ensure the confidentiality and security of the uploaded documents.

- Ease of Use: The platform is intuitive, making it simple for clients to submit requested files without technical difficulties.

- Customization: Users can customize requests with specific descriptions and deadlines, tailoring the collection process to their needs.

- Integration: It offers integration with popular accounting software and platforms, streamlining the workflow.

Disadvantages:

- Cost: While it offers a free trial, the full-featured version of File Request Pro comes with a subscription fee.

- Limited Storage: Depending on the subscription plan, there may be limitations on storage capacity, which could require periodic data purging.

These three file request tools offer varying levels of document collection and management capabilities for accounting professionals. The choice between them should be based on the specific needs and budget of the accounting firm or professional.

Conclusion

As we have journeyed through the multifaceted realm of securely collecting information in the digital age, it has become abundantly clear that this practice is not merely a choice but an unwavering necessity. The consequences of inadequate data security are far-reaching, touching every facet of an organization, from its financial health and reputation to its legal standing and operational efficiency. Therefore, it is incumbent upon organizations to recognize the vital role they play in upholding the integrity and security of the financial world.

As we navigate the complexities of modern accounting, it is a priority to remember that the security of financial data is not a mere practice; it is an ethical and strategic commitment. It is the assurance that the trust placed in accountants and organizations remains steadfast, unshaken, and well-deserved. In the pursuit of financial excellence, safeguarding sensitive information stands as the fortress that guards the integrity of our profession and the vitality of the financial world.