A mortgage document portal gives borrowers a single, secure place to upload income statements, tax returns, bank records, and identification — and gives loan officers a single place to track what has been received and what is still outstanding. Without one, document collection happens over email, text messages, and sometimes fax, creating delays, security risks, and a frustrating experience for everyone involved.

This guide explains what a mortgage document portal does, the features that matter most, how the main mortgage document portal solutions compare, and how to set one up for your lending operation.

What Is a Mortgage Document Portal?

A mortgage document portal is a secure online platform where borrowers submit the documents required during the loan origination process. Instead of emailing pay stubs and bank statements back and forth, borrowers log into or access a portal, see exactly which documents are needed, and upload them directly.

On the lender side, the portal collects and organizes everything in one place. Loan officers, processors, and underwriters can see in real time which documents have been submitted, which are still missing, and whether uploaded files meet requirements — without digging through email threads or shared drives.

Who uses mortgage document portals?

Mortgage document portals are used across the lending industry:

- Mortgage brokers collecting documents from multiple borrowers simultaneously across different lenders

- Loan officers at banks and credit unions managing their pipeline from application through closing

- Mortgage processors who need to verify document completeness before passing files to underwriting

- Correspondent lenders gathering documentation to package loans for sale to investors

- Title companies and settlement agents collecting closing documents from multiple parties

Any organization that collects financial documents from borrowers as part of the lending process benefits from a dedicated borrower document portal rather than relying on email or generic file-sharing tools.

Why email falls short for mortgage document collection

Email remains the default for many smaller lending operations, but it creates specific problems in the mortgage context:

- Security gaps. Borrowers email Social Security numbers, tax returns, and bank statements through unencrypted channels. A single misdirected email exposes personally identifiable information (PII) and creates compliance liability.

- No tracking. When a borrower sends three of five required documents across two emails, the processor has to manually track what arrived and what is missing. Multiply this across 30 active loans and a processor can spend five or more hours a week chasing document status alone.

- File size limits. Email attachment limits (typically 10-25 MB) force borrowers to split submissions or compress files, which often results in illegible scans.

- Lost documents. Files buried in email threads get overlooked, leading to duplicate requests that frustrate borrowers and slow the process.

- Audit trail gaps. Regulators and investors expect a clear chain of custody for borrower documents. Email does not provide a reliable audit log of when documents were requested, submitted, and reviewed.

A mortgage document portal solves each of these problems with a structured, trackable, and encrypted workflow.

Key Features of a Mortgage Document Portal

Not every portal offers the same capabilities. When evaluating options, these are the features that have the most impact on your loan processing efficiency and borrower experience.

Security and compliance

Mortgage documents contain some of the most sensitive personal and financial information a consumer will ever share. The portal you choose must meet the security standards your regulators and investors expect:

- Encryption in transit and at rest. All files should be encrypted using TLS during upload and AES-256 (or equivalent) while stored. This is the baseline — any portal without it should be disqualified immediately.

- Access controls. Role-based permissions ensure that only authorized team members can view borrower documents. A junior processor should not have the same access as the compliance officer.

- Audit logs. Every action — upload, download, view, deletion — should be logged with timestamps and user identification. These logs are essential during regulatory examinations and investor audits.

- Data retention policies. The portal should support configurable retention periods so you can comply with state and federal record-keeping requirements without storing data longer than necessary.

- SOC 2 or equivalent certification. Independent security audits verify that the platform's security controls hold up under scrutiny — which matters when investors or regulators ask how you protect borrower data.

Compliance with the Gramm-Leach-Bliley Act (GLBA), which requires financial institutions to protect consumer financial information, is non-negotiable. Some portals also support compliance with state-specific data privacy regulations.

Borrower experience

A portal that is difficult for borrowers to use will not get adopted, regardless of how powerful it is on the back end. The best mortgage document portals prioritize simplicity on the borrower side:

- No account creation required. Borrowers should be able to access the portal and upload documents without creating a username and password. Every additional step reduces completion rates.

- Mobile-friendly uploads. Many borrowers will photograph documents on their phones rather than scanning them. The portal should support direct photo uploads from mobile devices with a responsive interface.

- Clear document descriptions. Each requested document should include a plain-language explanation of what is needed and why. "Two most recent pay stubs showing year-to-date earnings" is far more effective than "Income verification."

- Progress indicators. Borrowers should see at a glance which items they have completed and which are still outstanding. This reduces anxiety and minimizes "did you get my documents?" calls.

- Multi-page and multi-file uploads. Bank statements and tax returns are multi-page documents. The portal should handle bulk uploads without forcing borrowers to upload one page at a time.

Workflow and automation

The real efficiency gains come from automation that eliminates manual follow-up:

- Automated reminders. When documents are outstanding past a set deadline, the portal sends reminder emails to borrowers automatically — targeted only at those with missing items. For a processor managing 30 loans, this can replace the two to three hours a week they currently spend on manual follow-up calls and emails.

- Automatic file organization. Uploaded documents should route directly to your storage system (cloud drive, LOS, or document management system), organized by borrower name, loan number, or document type — without manual sorting.

- Conditional logic. A self-employed borrower needs different documents than a W-2 employee. Conditional logic in the upload form adapts the document request based on the borrower's answers, so they only see what applies to them.

- Status notifications. Loan officers and processors should receive alerts when borrowers upload documents, so they can review submissions promptly rather than checking the portal manually.

- Template reuse. Create a standard document request template for conventional loans, another for FHA, another for VA — and deploy them instantly for new borrowers without rebuilding from scratch.

Integrations

A mortgage document portal should fit into the tools you already use, not replace them:

- Cloud storage. Direct integration with Google Drive, OneDrive, SharePoint, or Dropbox ensures documents land in your existing file structure.

- Loan origination systems (LOS). Some portals connect directly to platforms like Encompass, Byte, or Calyx, pushing documents into the loan file automatically.

- CRM and pipeline tools. Integration with your CRM allows you to trigger document requests at specific pipeline stages.

- Zapier or API access. For custom workflows, API access or Zapier integration lets you connect the portal to tools that do not have native integrations.

Top Mortgage Document Portal Software

The mortgage industry has several loan document portal solutions, ranging from features built into loan origination systems to standalone document collection platforms. Here is how the main options compare.

Encompass by ICE Mortgage Technology

Encompass is the dominant loan origination system in the U.S. mortgage industry. Its borrower-facing portal, now marketed as ICE Mortgage Technology's Borrower Portal, handles document uploads as part of the broader loan application workflow.

- Strengths: Deep integration with the LOS means documents go directly into the loan file. Compliance features are built for mortgage-specific regulations. Borrowers can track loan status and upload documents in the same place.

- Limitations: Encompass is an enterprise platform with enterprise pricing. Smaller brokerages and independent loan officers may find the cost and complexity disproportionate to their needs. The borrower experience is functional but not always intuitive.

- Best for: Mid-size to large lenders already using Encompass as their LOS.

SimpleNexus (now nCino Mortgage)

SimpleNexus provides a mobile-first borrower experience with a dedicated app for document uploads, loan status tracking, and communication between borrowers and loan officers.

- Strengths: Excellent mobile experience. Borrowers can photograph and upload documents directly from the app. Integrates with major LOS platforms including Encompass and Byte. Loan officers get real-time notifications.

- Limitations: Requires borrowers to download an app, which adds friction. Pricing is geared toward larger operations. Since the nCino acquisition, the product has shifted toward enterprise-scale deployments.

- Best for: Lenders who want a polished mobile borrower experience and have the volume to justify the investment.

Blend

Blend offers a digital lending platform that covers the entire loan lifecycle, from application through closing. Its document collection portal is part of a broader suite that includes automated income and asset verification.

- Strengths: Consumer-grade interface that feels modern and approachable. Supports direct data pulls from banks and employers, reducing the number of documents borrowers need to upload manually. Strong compliance framework.

- Limitations: Blend is a full lending platform, not just a document portal. Organizations looking specifically for document collection will be paying for capabilities they may not need. Implementation timelines can be lengthy.

- Best for: Lenders seeking to digitize the full origination workflow, not just document collection.

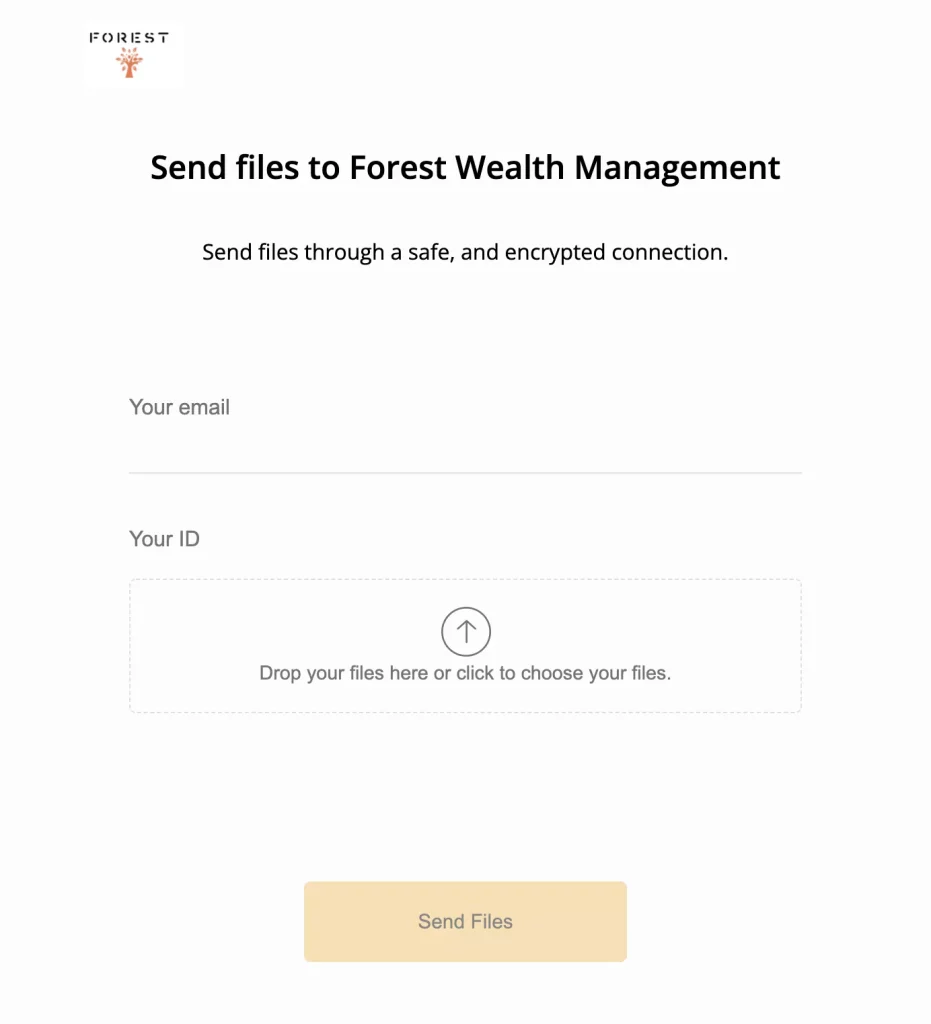

File Request Pro

File Request Pro is a dedicated document collection platform that provides branded upload pages where borrowers submit documents without creating an account. It is not a mortgage-specific tool — it is used across accounting, legal, real estate, and financial services — but its features map directly to mortgage document collection needs.

- Strengths: No borrower login required, which removes friction and increases completion rates. Multi-page upload forms with conditional logic adapt to each borrower's situation (W-2 vs. self-employed, purchase vs. refinance). Uploaded files route automatically to Google Drive, OneDrive, SharePoint, or Dropbox, organized by borrower name or loan number. Automated reminder sequences chase outstanding documents without processor intervention. AES-256 encryption and audit logs. Plans start at a fraction of what mortgage-specific enterprise platforms cost — typically under $30/month for most lending teams.

- Limitations: Does not include LOS functionality — it handles document collection only, not loan processing. No native integration with Encompass or other LOS platforms, though Zapier connections bridge the gap for teams that need to push files into their LOS. Does not include loan status tracking, which keeps it focused on the collection workflow rather than trying to be an all-in-one borrower portal.

- Best for: Mortgage brokers, independent loan officers, and small to mid-size lenders who need a fast, affordable, and borrower-friendly way to collect documents without committing to an enterprise platform.

Generic cloud storage (Google Drive, Dropbox, OneDrive)

Some lending operations use cloud storage file request features (Dropbox File Requests, OneDrive file requests) or simply share folders with borrowers for document uploads.

- Strengths: Low or no additional cost if you already pay for the storage platform. Familiar to most users.

- Limitations: No conditional logic, no automated reminders, no structured document checklists, limited audit trails, and no progress tracking. Borrowers often need accounts on the same platform. Not designed for collecting structured sets of documents from external parties.

- Best for: Solo practitioners processing a small number of loans who need a basic solution with minimal cost.

How to Set Up a Mortgage Document Portal

If you are using email or basic file-sharing tools today, setting up a dedicated mortgage document portal does not need to be a large IT project. Here is a practical approach using a standalone document collection tool.

Step 1: Define your document checklists by loan type

Start with your most common loan types and list every document you request. A conventional purchase loan checklist typically includes:

- Government-issued photo ID

- Two most recent pay stubs

- W-2 forms (last two years)

- Federal tax returns (last two years)

- Bank statements (last two months, all pages)

- Investment and retirement account statements

- Purchase agreement / sales contract

- Earnest money deposit verification

- Gift letter and donor bank statements (if applicable)

- Homeowner's insurance quote

- Landlord contact information or mortgage statements (housing history)

For self-employed borrowers, add: business tax returns (last two years), profit and loss statements (year-to-date), business bank statements, and business license. For refinances, add the current mortgage statement, property tax bill, and homeowner's insurance declaration page.

Step 2: Build your upload form

Create a multi-page upload form that walks borrowers through the checklist step by step. Group documents into logical sections — personal identification, income, assets, property — so the task feels manageable rather than overwhelming.

Add conditional logic so the form adapts. When a borrower selects "Self-employed" as their employment type, the form shows business document requests. When they select "W-2 Employee," those sections are hidden. This keeps the experience clean and relevant.

Write clear, plain-language descriptions for each document request. Instead of "VOE," write "Verification of Employment — a letter from your employer confirming your position, start date, and salary." Borrowers are not mortgage professionals; do not assume they know the terminology.

Step 3: Configure file routing and storage

Connect the portal to your cloud storage. Set up dynamic folder creation so that each borrower's documents are automatically organized into a folder named with their name and loan number. This eliminates the manual step of downloading, renaming, and filing documents.

If your team uses Google Drive, set the portal to create a folder structure like: Loans / [Borrower Last Name, First Name] / [Document Type]. Every uploaded file lands in the right place without anyone on your team touching it.

Step 4: Set up automated reminders

Configure a reminder sequence that triggers when documents remain outstanding. A typical sequence might be:

- Day 3: Gentle reminder noting which specific documents are still needed

- Day 7: Follow-up with a note about the impact on processing timeline

- Day 14: Final notice before the deadline, with a direct link to the upload page

Automated reminders should only go to borrowers with outstanding items. Those who have already submitted everything should not receive follow-ups. This single feature saves processors hours of manual phone calls and emails each week.

Step 5: Brand the experience

Add your company logo, colors, and a welcome message to the upload page. The portal is often the borrower's first hands-on interaction with your operation after the initial application. A branded, professional-looking page reinforces that they are working with an organized lender who takes their information seriously. A generic or confusing interface does the opposite — and can lead to borrowers calling your office instead of uploading on their own.

Step 6: Test with your team, then deploy

Before sending the portal link to borrowers, have your processors and loan officers test the full workflow. Upload test documents, verify that files arrive in the correct storage folders, confirm that reminders trigger correctly, and check the mobile experience on both iOS and Android devices.

Once tested, integrate the portal link into your loan officer workflows. Include it in the initial welcome email, in your LOS task templates, and on your company website. For a deeper look at streamlining the broader collection process, see our guide on mortgage document collection best practices.

Mortgage Document Collection Compliance Requirements

Document collection in the mortgage industry is not just about efficiency. Several regulations govern how borrower information must be handled.

Gramm-Leach-Bliley Act (GLBA)

GLBA requires financial institutions to explain their information-sharing practices and safeguard sensitive data. Your document portal must include administrative, technical, and physical safeguards to protect borrower information from unauthorized access.

TRID (TILA-RESPA Integrated Disclosure)

While TRID primarily governs loan disclosures, it creates timing requirements that affect document collection. Delays in gathering borrower documents can push you past disclosure deadlines, so an efficient portal helps maintain TRID compliance indirectly.

ECOA and fair lending

The Equal Credit Opportunity Act requires consistent treatment of all applicants. A standardized document portal ensures every borrower receives the same request, reducing the risk of inconsistent practices that could raise fair lending concerns.

State data privacy laws

States including California (CCPA/CPRA), Virginia (VCDPA), and Colorado (CPA) have enacted data privacy laws that affect how you collect, store, and delete borrower information. Your portal should support data retention policies and deletion capabilities to comply with these requirements.

Frequently Asked Questions

What documents do borrowers typically upload through a mortgage document portal?

The standard document set includes government-issued identification, pay stubs, W-2 forms, federal tax returns, bank statements, investment account statements, the purchase agreement, and proof of homeowner's insurance. Self-employed borrowers also submit business tax returns, profit and loss statements, and business bank statements. The exact requirements vary by loan type (conventional, FHA, VA, jumbo) and the borrower's financial situation.

Do borrowers need to create an account to use a mortgage document portal?

It depends on the platform. Enterprise solutions like Encompass and Blend typically require borrowers to create accounts. Standalone document collection tools like File Request Pro allow borrowers to upload documents through a secure link without any account creation. Removing the login step tends to increase completion rates, particularly with borrowers who are less comfortable with technology — they click the link, see what is needed, and start uploading without hitting a registration wall.

Is it secure to collect mortgage documents through an online portal?

A properly configured portal is far more secure than email. Look for TLS encryption during file transfer, AES-256 encryption for stored files, role-based access controls, and full audit logging. These protections are stronger than email, which typically transmits attachments without encryption and stores them in inboxes accessible to anyone with the email password.

How long does it take to set up a mortgage document portal?

Enterprise platforms like Encompass or Blend can take weeks or months to implement due to integration requirements and organizational change management. A standalone tool like File Request Pro can be configured in a day — build your document checklist, connect your cloud storage, set up reminder sequences, and add your branding. Most of the setup time goes into writing clear document descriptions, not configuring the technology.

Can a mortgage document portal replace my loan origination system?

No. A document portal handles one specific part of the loan process: collecting and organizing borrower documents. It does not replace your LOS, which manages the full loan lifecycle from application through closing. Many lenders use a document collection portal alongside their LOS, with the portal feeding documents into the LOS either through direct integration or manual upload.

What if a borrower uploads the wrong document?

Most portals allow loan officers to flag submitted documents and request resubmission with a note explaining what is needed instead. The best portals include clear descriptions for each document request, which reduces incorrect submissions in the first place. Adding example images or sample documents can further reduce errors.

Start Collecting Mortgage Documents the Right Way

If your team is still collecting borrower documents over email, every loan in your pipeline carries unnecessary risk and delay. A dedicated mortgage document portal gives borrowers a clear path to submit what you need, keeps your files organized and encrypted, and frees your processors from hours of manual follow-up.

See how File Request Pro works — set up your first document checklist in under an hour, no IT team required.