A well-designed tax planning questionnaire helps accountants gather the right information from clients before year-end, setting the stage for smarter tax strategies and lower tax bills.

A good tax planning questionnaire covers income, expenses, investments, and life changes. It addresses both the present and the future, helping accountants spot risks and find opportunities to reduce tax liability.

The right questions lead to better advice. They help accountants see the full picture of a client's finances — not just what happened last year, but what is coming next. This article provides a tax planning questionnaire template with over 130 questions organized by category, ready to adapt for your practice.

Personal Information

Gathering personal details is the foundation of accurate tax planning. These questions establish a client's basic profile and circumstances.

Identification Details

- What is your full legal name?

- What is your date of birth?

- What is your Social Security number?

- What is your current home address?

- What is your primary phone number?

- What is your email address?

Family Status

- What is your current marital status?

- If married, what is your spouse's full name?

- What is your spouse's Social Security number?

- Do you have any dependents?

- For each dependent, what is their name and date of birth?

- Are you or your spouse legally blind or disabled?

Employment Information

- What is your current occupation?

- Who is your current employer?

- What is your employer's address?

- Are you self-employed or do you own a business?

- If self-employed, what is your business name and type?

- Do you have any other sources of income?

- What is your spouse's occupation and employer?

Income Assessment

Your questionnaire should cover every major income category to build a complete financial picture.

Salary and Wages

- What is your annual salary?

- Do you receive any bonuses or commissions?

- How often are you paid?

- Do you have multiple employers?

- Are you eligible for any employee stock options?

- Do you receive any non-cash compensation?

- Have you had any changes in employment status this year?

Investment Income

- What types of investment accounts do you have?

- Do you receive any dividend income?

- Have you sold any stocks or bonds this year?

- Do you have any rental property income?

- Are you involved in any passive investments?

- Have you received any capital gains distributions?

- Do you have any foreign investments?

Business Income

- Do you own a business or are you self-employed?

- What is your business structure (sole proprietorship, LLC, corporation)?

- What was your gross business income this year?

- Do you have any business partners?

- Have you made any major business purchases this year?

- Do you use your home for business purposes?

- Have you hired any employees or contractors?

Other Income Sources

- Do you receive any pension or retirement income?

- Have you taken any distributions from retirement accounts?

- Do you receive Social Security benefits?

- Have you won any prizes, awards, or gambling income?

- Do you receive any alimony or child support?

- Have you received any inheritance or gifts?

- Do you have any income from royalties or patents?

Deductions and Credits

Tax deductions and credits can reduce your client's tax bill by thousands of dollars. These questions help identify which tax-saving opportunities they may qualify for.

Standard Deduction Eligibility

- Are you married filing jointly, single, or head of household?

- Are you age 65 or older?

- Are you legally blind?

- Can someone claim you as a dependent?

Itemized Deductions

- Did you pay mortgage interest or property taxes?

- Did you make any charitable donations?

- Did you have significant medical expenses?

- Did you pay state and local taxes?

- Do you have any unreimbursed employee expenses?

Education Credits

- Did you or a dependent pay tuition for higher education?

- What was the total amount of qualified education expenses?

- Was the student enrolled at least half-time?

- Has the student completed their first four years of post-secondary education?

- Did you receive any scholarships or grants?

Child and Dependent Care

- Do you have children under age 13?

- Did you pay for childcare while you worked or looked for work?

- What was the total amount spent on childcare?

- Do you care for a disabled spouse or dependent?

- Did you pay for in-home care services?

Tax Liability Considerations

These questions help assess a client's current and future tax obligations, covering past payments, estimated taxes, and potential alternative minimum tax situations.

Previous Year Tax Payments

- Did you owe taxes or receive a refund last year?

- What was the amount of your tax liability or refund?

- Were there any penalties or interest charges on your previous return?

- Did you file your taxes on time last year?

- Were there any issues or discrepancies with your last return?

Estimated Tax Payments

- Do you make quarterly estimated tax payments?

- What is the amount of your typical estimated tax payment?

- Have you missed any estimated tax payments this year?

- Do you anticipate changes in income that may affect your estimated payments?

- Are you satisfied with your current estimated tax payment schedule?

Alternative Minimum Tax

- Have you ever been subject to the Alternative Minimum Tax (AMT)?

- Do you have any large deductions that might trigger AMT?

- What is your current income level in relation to AMT thresholds?

- Do you have significant long-term capital gains or qualified dividends?

- Are you exercising any incentive stock options this year?

Retirement Planning

Retirement planning is a key part of tax strategy. Contributions to retirement accounts often reduce taxable income in the current year, while the right account types can shape a client's tax picture for decades. These questions help identify opportunities to optimize savings and reduce current liability.

Retirement Account Contributions

- How much do you currently contribute to retirement accounts each year?

- Are you maximizing your retirement account contributions?

- Do you plan to increase your retirement contributions this year?

- Have you considered catch-up contributions if you are over 50?

Employer-Sponsored Plans

- Does your employer offer a 401(k) or similar retirement plan?

- What is your current contribution rate to your employer-sponsored plan?

- Does your employer offer matching contributions?

- Are you taking full advantage of any employer match?

- Have you reviewed your investment choices within your employer plan recently?

IRA Contributions

- Do you currently contribute to an IRA?

- Are you eligible for a traditional IRA or Roth IRA?

- Have you considered converting a traditional IRA to a Roth IRA?

- Are you aware of the current IRA contribution limits?

- Do you plan to make IRA contributions for the current tax year?

Investment Strategies

The way investments are held, sold, and timed directly affects what a client owes. These questions uncover opportunities for smarter tax positioning.

Capital Loss Carryover

- Have you sold any investments at a loss this year?

- Do you have any capital losses from previous years that you have not used yet?

- Are you planning to sell any investments that have gone up in value?

- Have you considered using tax-loss harvesting to offset capital gains?

Tax-Exempt Investments

- Do you own any municipal bonds?

- Are you interested in tax-free income from investments?

- Have you looked into tax-exempt money market funds?

- Are you in a high tax bracket where tax-exempt investments might be beneficial?

Tax-Deferred Investments

- Are you maxing out your 401(k) contributions?

- Do you have an IRA? If so, what type?

- Have you considered a Health Savings Account (HSA) for tax-deferred growth?

- Are you using any annuities as part of your investment strategy?

- Have you thought about 529 plans for education savings?

Estate and Gift Tax Planning

Estate and gift tax planning involves strategies to minimize taxes when transferring wealth. For clients with large estates, these questions can reveal planning opportunities that reduce what their heirs owe.

Lifetime Gift Exclusions

- What is your current annual gift tax exclusion amount?

- Have you made any gifts exceeding the annual exclusion limit?

- Are you aware of the lifetime gift tax exemption?

- Have you used any of your lifetime gift tax exemption?

- Do you plan to make large gifts in the near future?

- Have you considered setting up a trust for gifting purposes?

Estate Tax Thresholds

- What is your estimated total estate value?

- Are you aware of the current federal estate tax exemption amount?

- Does your state have its own estate or inheritance tax?

- Have you considered strategies to reduce your taxable estate?

- Do you have a will or trust in place?

- Have you designated beneficiaries for your retirement accounts and life insurance policies?

- Are you interested in charitable giving as part of your estate plan?

Life Changes and Special Circumstances

Major life events can reshape a client's tax situation overnight. These questions catch changes that might otherwise be overlooked until it is too late to plan around them.

Major Life Events

- Did you get married or divorced this year?

- Did you have or adopt a child?

- Did you buy or sell a home?

- Did you move for work or personal reasons?

- Did you start or close a business?

- Did you experience a significant change in income?

- Did you receive a large inheritance or gift?

Health and Insurance

- Do you have health insurance coverage for the full year?

- Did you contribute to a Health Savings Account (HSA) or Flexible Spending Account (FSA)?

- Did you have any major medical expenses not covered by insurance?

- Did you receive any long-term care benefits?

- Did you purchase or change life insurance policies?

Education and Student Loans

- Are you or a dependent currently enrolled in a degree program?

- Did you pay student loan interest this year?

- Did you withdraw from a 529 plan for educational expenses?

- Did you receive any employer-provided educational assistance?

Automate Your Tax Planning Questionnaire

Having the right questions is only half the challenge. Collecting responses and supporting documents from clients — on time and in an organized way — is the other half.

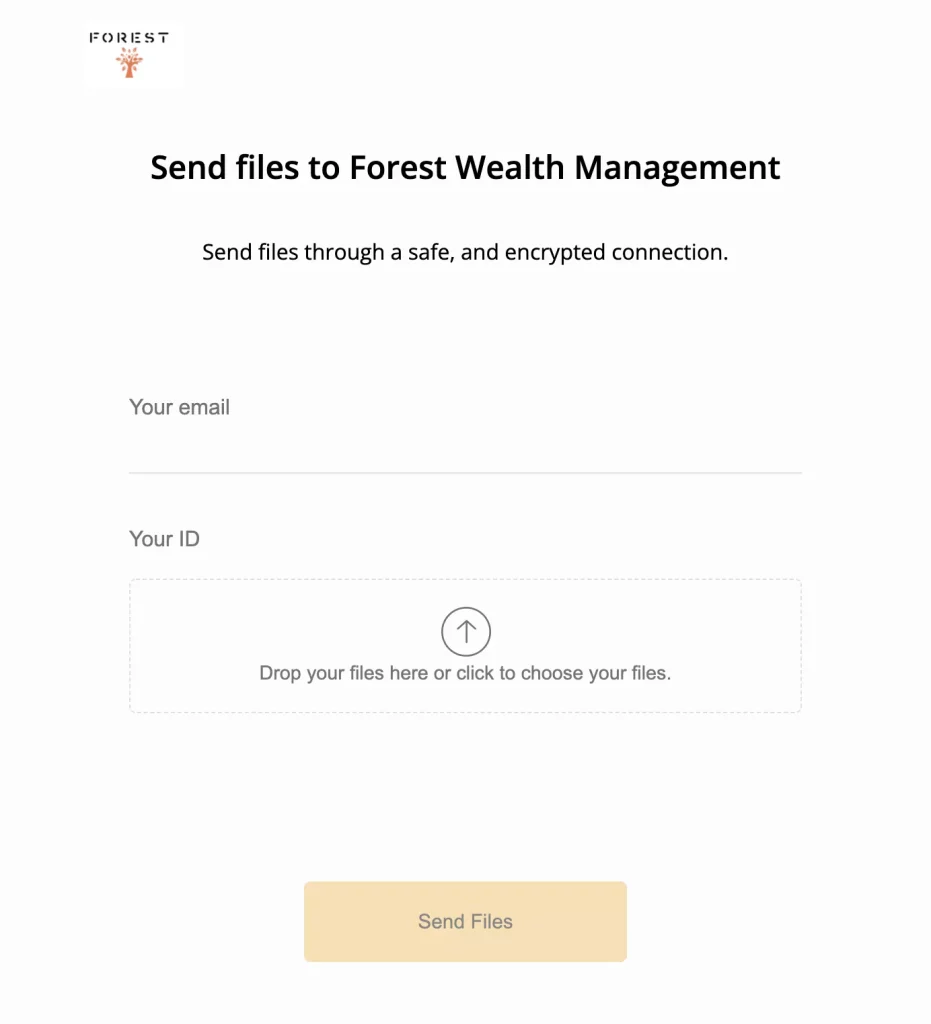

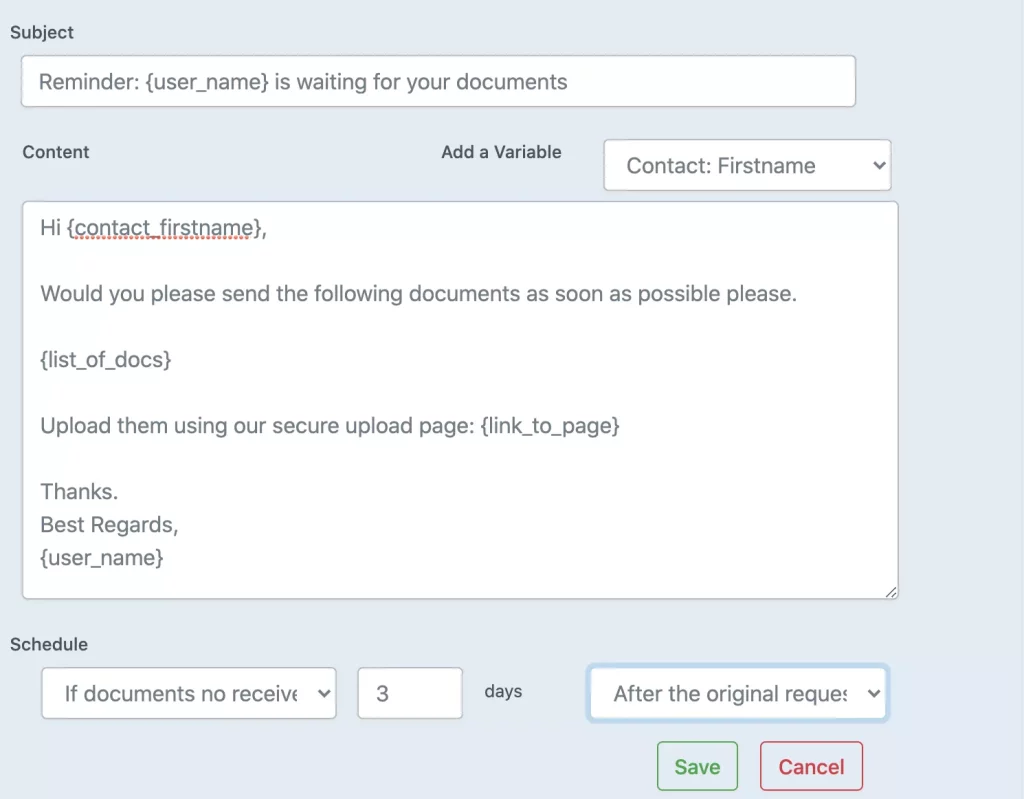

File Request Pro lets accountants create branded upload pages where clients can answer questionnaire fields and upload tax documents in one place. You define the questions and file requests; clients see a clear, step-by-step page with no account creation required.

Automated reminder emails keep clients on track, so you spend less time chasing responses. All uploads sync directly to your cloud storage — Google Drive, OneDrive, SharePoint, or Dropbox — organized by client.

This means less time on administrative follow-up and more time on the analysis and strategy that clients value most.

Frequently Asked Questions

What should a tax planning questionnaire include?

A tax planning questionnaire should cover personal information, all income sources (salary, investments, business, and other income), deductions and credits, tax liability history, retirement planning, investment strategies, and estate and gift tax considerations. The goal is to capture everything an accountant needs to build a workable tax strategy.

How is a tax planning questionnaire different from a tax preparation questionnaire?

A tax preparation questionnaire focuses on gathering documents and data needed to file a return for the current year. A tax planning questionnaire looks ahead — it explores future income changes, retirement goals, investment strategies, and life events that could affect tax liability in coming years. Tax planning is proactive; tax preparation is reactive.

When should accountants send a tax planning questionnaire to clients?

Most accountants send tax planning questionnaires in the fourth quarter, giving clients time to take action before year-end. For example, a client might increase retirement contributions, harvest capital losses, or make charitable donations based on the planning discussion. Sending the questionnaire early enough to act on the answers is key.

How do you collect tax planning questionnaire responses securely?

Avoid collecting sensitive tax information through regular email. Secure options include client portals, encrypted file-sharing services, and dedicated document collection tools like File Request Pro that offer branded upload pages with automatic cloud storage sync. These tools protect client data and keep responses organized.

Can I customize this tax planning questionnaire template?

Yes. This template is designed as a starting point. You should add or remove questions based on your client base. For example, accountants who primarily serve small business owners may expand the business income and deduction sections, while those focused on high-net-worth individuals may add more detailed estate planning questions.

How often should a tax planning questionnaire be updated?

Review and update your questionnaire at least once a year. Tax laws change regularly, and new deductions, credits, or reporting requirements may require additional questions. Keeping your questionnaire current ensures you capture all relevant information and do not miss planning opportunities for your clients.