Tax season is always a busy and stressful time around the office. Navigating clients can be tough as well when they don’t want to cooperate, slow down, or don’t respond sincerely.

As accountants and bookkeepers, you understand the importance of having a well-planned tax return checklist for clients. Every year thousands of people are at risk of facing hefty penalties from HM Revenue & Customs if they do not comply with stringent regulations.

As such, it is vitally important that you have in place an up-to-date, comprehensive checklist, one thing that’s important for running things smoothly: is a checklist of tax preparation documents to ensure your clients are filing accurate returns on time while avoiding costly misunderstandings or errors. This way, your clients know what they need to send or bring in.

That’s why you must put together a tax return checklist for clients. Share this list for a quick way to remind your clients how to prepare for tax season.

What is a Tax Return Checklist?

It is a helpful tool in the tax preparation process to ensure that all important documents and information necessary for filing taxes are ready. This type of checklist includes items such as recent tax forms, any past-year statements, a signed copy of the tax return, income information from employers, bank account records, and any other applicable forms for deductions or credits for their tax return in the tax season.

List of tax documents to collect

Every client’s list of requirements will be a little different. Giving them a list of documents broken down into categories can help them think through what they need to prepare for a tax appointment with a tax preparer.

Personal Information.

- Social Security numbers for those filing the return and dependents.

- Date of birth for those filing the return and dependents.

- Bank account information (for direct deposit).

Business Information.

Owning and operating a business adds even more complexity to annual taxes. Business owners need to submit additional info to get started. Be sure to include these items on your checklist for business owners:

- Prior year’s corporate tax return.

- EIN, if applicable.

- Partnership agreements, if applicable.

- Change in ownership information, if applicable.

- Bank account details.

Income.

- W2 forms.

- 1099 forms – Could include 1099-MISC, 1099-B, 1099-C, 1099-G, 1099-R, 1099-S, 1099-SA, 1099-INT, 1099-DIV, 1099-LTC, and more.

- Alimony received.

- Business income.

- Rental property income.

- Dividend income statements.

Personal Deductions and Credits.

- Retirement account contributions.

- Charitable contributions.

- Form 1098 (Mortgage Interest Statement).

- Medical expenses.

- Family medical expenses.

- Form 1098-T and Form 1098-E for education expenses such as tuition paid and student loan information.

- Child care expenses (Must include name, address, and tax ID of child care provider).

- Adoption costs.

- Home office information – The square footage of the office, the date the space started being used for a home office, and utility expenses are needed to claim on the tax return.

- Unemployment compensation (If applicable)

- Establish if you have your own business or if you are self employed.

Tax Payments.

- Estimated tax payments throughout the year for self-employed taxpayers.

- Personal property taxes.

- Real estate taxes.

- Estimated tax payments.

How to collect tax information securely.

These days, documents that used to be hand-delivered at the accounting office have to be done digitally (by email or personal Dropbox) or through courier services.

Regardless of the method you use to share information, privacy must always be your #1 concern, especially since financial records contain information that could be used for identity theft or other malicious activities if it landed in the wrong hands.

Ship encrypted flash drives.

Sending tax-related documents by courier can end up being a gamble if you’re mailing paper copies. Even though rare, your packages can get lost in the mail, and then your information could be given to a third party.

It’s better to use encrypted flash storage if you still want to send docs by courier. By including the encrypted flash drive in a secure post, it will be much more difficult for individuals to access the files stored on your flash drive without the password, meaning that they would need to know this information.

Email password-protected documents.

Emails are not encrypted, meaning that after you’ve clicked “send” an unauthorized third party could intercept and read any confidential information you were about to send. This can lead to serious security risks in terms of intellectual property theft or leaked company data.

Just to be safe, you should always password-protect your documents before you’re uploading them as an attachment.

Creating password-protected zip files is easy if you have software like WinRar or Winzip installed. Check out our tutorial on how to encrypt zip files before emailing them.

Use a Secure Portal or Document Collection tool.

Another way to transmit documents is to use a secure portal or upload the page to upload them.

Document collection software makes it easy for you to collect documents, folders, and extra content from clients and team members. It can be divided into these categories:

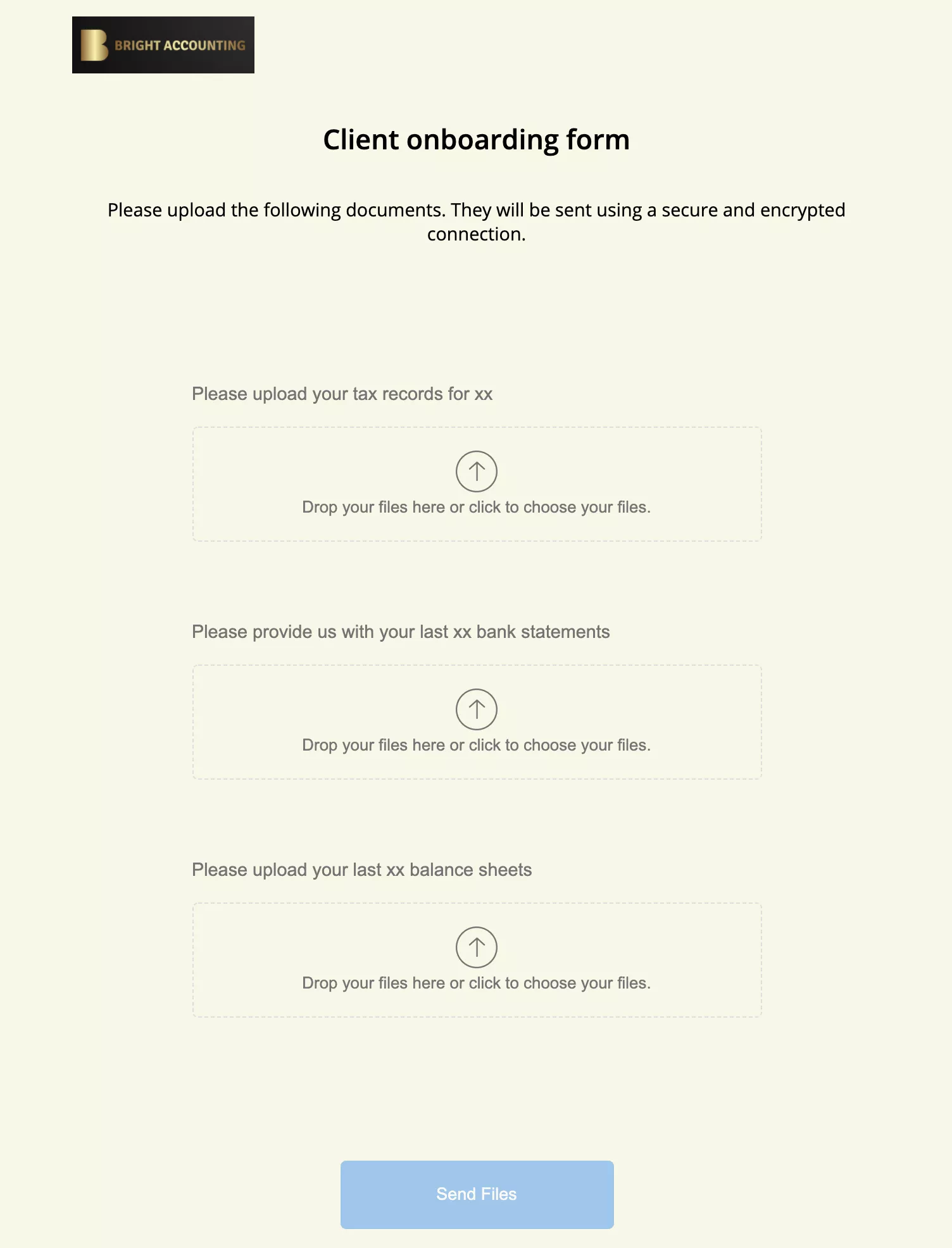

File upload page software is a part automation tool, part file upload software, and part form builder. It provides you with an easy way to request and organize files. Clients are not required to log in, and the user experience should be more like filling in an online form rather than learning how to use complex new software.

An effective client tax document collection form is simple for your client to use and guides them through what they need to upload.

This example has been created using File Request Pro:

If clients are sending you private and confidential data, you must make sure your data collection process is secure and trustworthy. Using unencrypted email or even links to shared cloud folders can be problematic.

In contrast, File Request Pro provides you with a secure way to collect data that is still easy for your clients to use. All our user data is encrypted at rest using AES 256-bit encryption algorithm.

If you’re a client, you can recommend this program to your accountant to help keep your own tax documents secure.

Ready to streamline your tax documents to the collection?

These are your next steps:

- Sign up for a free trial of File Request Pro.

- As part of the onboarding process, connect the software to your cloud service. the provider (Microsoft OneDrive, SharePoint, Google Drive, and Dropbox).

- Create a customized upload form (10-15 minutes).

- Send your first upload form to a new client, and link to it from your webpage or email signature.

TOTAL TIME TO IMPROVE YOUR ONBOARDING PROCESS = 15 minutes.