Year-end accounting is a critical and often daunting task for businesses of all sizes. As the calendar year draws to a close, companies must navigate a complex web of financial transactions, regulatory requirements, and data reconciliation to ensure accurate reporting and compliance. This process traditionally involves an exhaustive checklist, meticulous data gathering, and long hours of manual labor.

In this article, we will explore the concept of streamlining year-end accounting with automation through a comprehensive checklist. We will delve into the myriad benefits that automation brings to this crucial financial undertaking, from enhanced accuracy and efficiency to improved data security and compliance.

Year End Accounting Checklist

Step 1: Evaluate and reconcile financial statements

Evaluating and reconciling financial statements is an essential step in the year-end accounting process, as it provides a clear snapshot of a company’s financial health, aids in detecting any irregularities or inconsistencies, and serves as the foundation for informed decision-making and regulatory compliance.

Reviewing and comparing a company’s financial documents, such as:

- Balance sheets.

- Income statements.

- Cash flow statements.

Step 2: Review and update chart of accounts

With this step businesses can improve their financial clarity, reduce the risk of errors, and make informed decisions based on more concise and accurate financial data; you just must make sure to:

- Ensure accuracy and relevancy: which means that all financial categories accurately reflect the current state of the business. This ensures that financial reports and statements provide a true and up-to-date picture of the company’s financial position.

- Eliminate redundancies: preventing the cluttering of financial records with duplicate or unnecessary accounts.

Step 3: Audit accounts receivable and accounts payable.

This involves a meticulous examination of outstanding invoices and customer payments to ensure accuracy and completeness. It ensures that the company is receiving payments for goods or services delivered and identifies any overdue or potentially uncollectible amounts.

It helps in confirming that the company is meeting its financial obligations to suppliers and vendors, while preventing erroneous or duplicate payments. For this, you must make sure to verify and confirm:

- Outstanding invoices.

- Outstanding bills.

Step 4: Assess inventory and fixed assets

Assessing inventory and fixed assets is a crucial aspect of financial management for businesses.

- Conduct physical inventory count refers to the tangible goods and products a company holds for sale or production. Assessing inventory involves tracking the quantity, value, and condition of these goods, ensuring accurate financial reporting and efficient inventory management.

- Reevaluate asset depreciation: this encompasses long-term assets like buildings, machinery, and equipment that are essential for business operations, and involves determining their current value, depreciation, and overall condition to maintain accurate balance sheets and make informed decisions about what needs maintenance or needs to be replaced.

Step 5: Analyze tax liability and provisions

This final step involves a thorough examination of a company’s financial records and transactions to assess its anticipated tax obligations and the necessary provisions to cover those liabilities. This process encompasses:

- Calculating income taxes.

- Reviewing tax deductions and credit.

- Ensuring compliance with tax laws and regulations.

When the End of the year in accounting approaches, follow each of these steps and check off the checklist of small tasks and documents that need to be ready within each step for a more organized and smooth process.

With this checklist, you will have a clear vision of where to start and what you need to have prepared. Having clarity on what needs to be done to close the accounting year is important, but likewise, each of the tasks that must be fulfilled requires many small manual activities, which, as we already know, take more time than we think and have their own risks.

Benefits of Automation in Year-End Accounting

Automation has become a game-changer in the world of finance and accounting, offering a plethora of benefits that can revolutionize how businesses approach year-end accounting. Some of these benefits can be:

Improved accuracy and reduced human error

Human error is an inherent challenge in any manual or repetitive task, and year-end accounting is no exception. Automation ensures that tasks are performed consistently according to predefined rules and standards. This eliminates the variability that can result from human interpretation and judgment, reducing the chances of errors caused by inconsistent practices. Automatization tools and processes are less prone to typographical errors, transposition mistakes, or miscalculations that humans might make when handling extensive datasets.

Time-saving opportunities

Every minute saved can be redirected toward critical tasks, decision-making, and strategic planning. Automation in year-end accounting presents significant time-saving opportunities, allowing businesses to allocate their resources more efficiently.

For example, year-end accounting often involves gathering data from multiple departments or branches. Automation tools like file request can consolidate data in real-time, reducing the time spent manually collecting and reconciling information from different sources.

Enhanced data security

Data security is a paramount concern in today’s digital age, especially when handling sensitive financial information during year-end accounting processes. Automation not only streamlines tasks but also significantly enhances data security in several keyways like access control, user authentication, encryption, audit trails, data backup and recovery.

Increased compliance with regulatory requirements

The consequences of even minor errors in financial reporting can be significant, potentially leading to financial discrepancies, compliance issues, and a loss of trust among stakeholders.

Automation assigns clear responsibilities within the compliance process. It ensures that specific individuals or teams are accountable for compliance-related tasks. This transparency promotes accountability and facilitates a culture of compliance within the organization.

We understand that automating our tasks for year-end accounting closure is crucial, but where should I begin this closure of the year? What are the first processes I should set in motion, and within them, what would be a comprehensive checklist of small tasks and documents that must be ready if I want this year-end accounting not to be a complete disaster?

3 Essential Automation Tools for Streamlining Year-End Accounting

The integration of automation tools has revolutionized this process, making it significantly more efficient and accurate. Here are three recommendations for automation tools, each serving a specific aspect of year-end accounting, depending on what is the most relevant need of your business, you can implement them all or try them one by one and see what works best for your business:

Inventory Management Automation

As we explored before in our step by step and checklist, managing inventory effectively is crucial for businesses across various industries. As year-end approaches, a reliable inventory management automation tool can be an invaluable asset. These tools help you maintain accurate inventory records, assess the value of your inventory, and ensure compliance with accounting standards. Popular inventory management automation options include:

- QuickBooks: Quickbooks has comprehensive inventory management features that automate the tracking of stock levels, order management, and sales forecasting. It seamlessly integrates with accounting software, making it a powerful tool for managing inventory during year-end accounting.

Financial Statement Preparation Software

Preparing financial statements is the first step and the heart of year-end accounting. Automation tools for financial statements simplify this process by pulling data from various sources, performing calculations, and generating accurate financial reports. One standout tool for this purpose is:

- Xero: is a cloud-based accounting software known for its robust financial reporting capabilities. It can automate the creation of balance sheets, income statements, and cash flow statements, providing you with up-to-date financial information for year-end reporting.

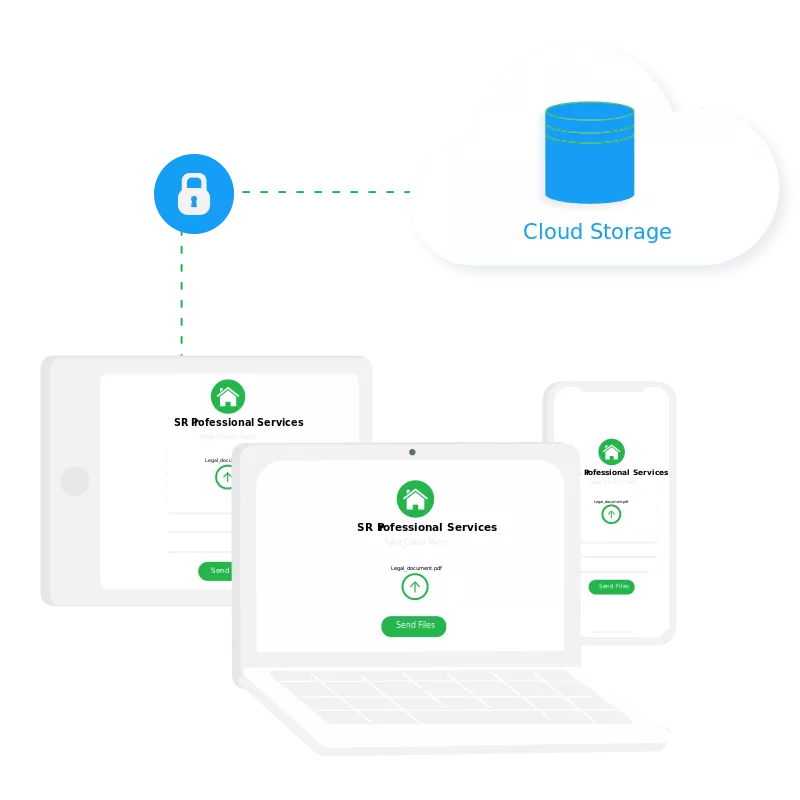

File Request and Document Collection Automation

Collecting the necessary documents and information from various stakeholders is a common challenge during year-end accounting. Automation tools for file requests streamline this process, allowing you to request, collect, and organize documents efficiently. A notable solution in this category is:

- File Request Pro: secure file sharing and request features that enable you to send personalized file requests to clients, vendors, or colleagues. It provides a centralized platform for collecting and storing important documents, reducing the risk of missing or misplaced information during year-end accounting.

Benefits of using File Request Pro for data collection.

- Organization: With File Request Pro, collected data is organized in a central location. This makes it easier to manage and access the information you need without sifting through countless emails or folders. With File Request Pro’s dynamic file organization, manual document sorting and content organization are a thing of the past. This system keeps files out of your inbox, reducing the likelihood of them getting misplaced.

- Customization: You can create specific and tailored requests for different purposes or types of data. This ensures that respondents provide the exact information you need in the required format.

- Clear Instructions: File Request Pro allows you to include clear instructions with your requests, minimizing any confusion and ensuring that respondents understand what is expected of them. You can set deadlines for responses, which encourages timely submissions and helps you plan your data collection process more effectively.

- Tracking and Notifications: automated notifications can be sent as reminders to those who haven’t submitted their data, improving response rates.

- Data Security: File Request Pro ensures the secure encryption and direct transmission of user data to your designated cloud account or dashboard. Uploading documents is only permitted for users with the appropriate link, and while you have the option to set a password, it’s not the default choice to maintain a streamlined user experience.

By incorporating these tools into your accounting processes, you can navigate the complexities of year-end accounting with greater ease, freeing up valuable time for strategic analysis and planning.

Now You Can Be the Master of Year-End Accounting!

Mastering year-end accounting is a crucial endeavor for businesses, and it’s no longer the daunting and time-consuming task it once was. With the integration of automation tools and a strategic checklist, the process becomes more efficient, accurate, and manageable.

Among these tools, File Requests Pro stands out as an efficient solution for data collection, offering organization, customization, and data security. With File Requests Pro, manual document sorting becomes a thing of the past, and data collection is transformed into a streamlined and secure process.

The modern era of business demands both time-saving efficiency and accuracy, and automation delivers on both fronts. So, embark on this journey of transformation, and make your year-end accounting a more efficient and less burdensome endeavor.