Anti-money laundering regulations (AML) are a raft of regulations designed to detect, deter and disrupt criminal activity. Know Your Customer checklists are part of AML and are specifically designed to help with customer identification and screening.

Any company with exposure to client risks, such as accountants, financial service businesses, and solicitors, must develop a KYC strategy for engaging with customers, although specific KYC requirements vary depending on the jurisdiction.

What is a know your customer check

A Know Your Customer (KYC) check is a process that businesses and financial institutions used to verify the identity of their customers to assess potential risks of illegal or fraudulent activities, such as money laundering or terrorism financing. The process typically involves collecting information such as a customer’s personal details, proof of identity, and proof of address. This helps businesses to comply with anti-money laundering and counter-terrorism financing regulations, and to ensure the integrity of their customer relationships.

Customer Due Diligence: What is CDD, AML, CFT & KYC?

1. CDD: Customer Due Diligence is the process of verifying the identity of a client and assessing their potential risk of involvement in illegal activities such as money laundering and terrorism financing.

2. AML: Anti-Money Laundering refers to a set of laws, regulations, and procedures designed to prevent individuals or entities from disguising the proceeds of criminal activity as legitimate income.

3. CFT: Counter Financing of Terrorism refers to the efforts to prevent funds from being raised or transferred to support terrorist activities.

4. KYC: Know Your Customer is the process of verifying the identity of a customer before conducting business with them, in order to prevent fraudulent activities and ensure compliance with regulations.

What Is KYC Compliance?

KYC stands for “Know Your Customer” and is a process used by financial institutions and other businesses to verify the identity of their customers. KYC compliance refers to the practice of businesses ensuring that they have verified the identity of their customers and have a clear understanding of their background and financial activities. This can include verifying identification documents, conducting background checks, and monitoring for suspicious activities. KYC compliance is important for preventing fraud, money laundering, and other financial crimes, and is a requirement for businesses in many jurisdictions.

Know your customer (KYC) framework

An effective strategy for gathering customer information is to divide the process into three stages.

1. Customer identification: Ascertain the identity of customers.

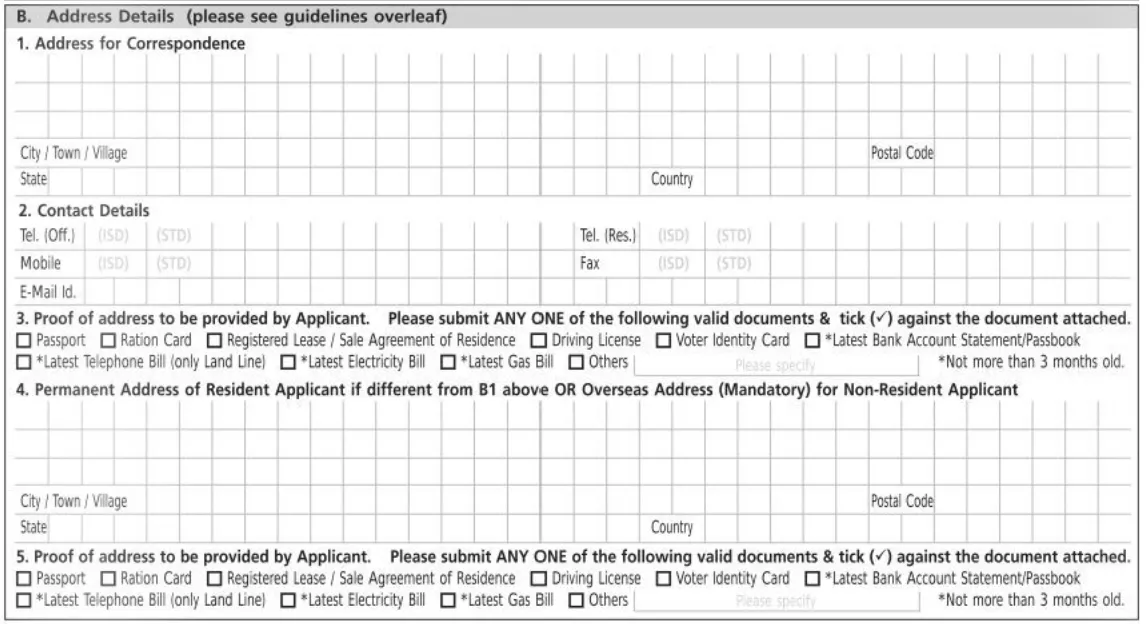

Customer identification refers to the process of confirming and verifying the identity of individuals who are seeking to engage in a transaction or business relationship with an organization. This typically involves obtaining and verifying personal information such as name, date of birth, address, and government-issued identification documentation. Customer identification is an important aspect of risk management, regulatory compliance, and preventing identity theft and fraud. It is often a legal requirement for certain businesses, such as financial institutions, to verify the identity of their customers. This process may involve the use of various methods and technologies, including document verification, biometric data, and identity verification services.

2. Conduct customer due diligence

Customer due diligence (CDD) is an important process that involves gathering information about a customer to assess their risk and ensure compliance with anti-money laundering and counter-terrorism financing regulations.

By conducting thorough customer due diligence, businesses can mitigate the risk of being involved in illicit activities and ensure compliance with regulatory requirements.

3. Enhanced due diligence

Enhanced due diligence should be undertaken in cases where the client has political connections, operates in a high-risk domicile, or exhibits other red flags. This may involve gathering additional information about the client and their business activities, conducting additional background checks, and seeking additional documentation that can help in assessing the risk associated with the client. Enhanced due diligence is an important tool for mitigating the risk of potential money laundering, terrorism financing, or other illegal activities. It is crucial to adhere to the regulations and guidelines set by the relevant authorities when conducting enhanced due diligence.

This framework needs to be implemented as part of your customer onboarding process.

Customer due diligence varies but generally means being clear about the nature of the business relationship and its intended purpose, the source and origin of funds, and the expected level and type of activity that will take place during your business relationship.

Enhanced due diligence may be required when customers:

- Are politically exposed.

- Are from a ‘high-risk’ country.

- Where there is a higher risk of money laundering.

You are also expected to continue to monitor customer activity for any red flag activities.

Know your customer’s (KYC) checklist.

A basic checklist might include:

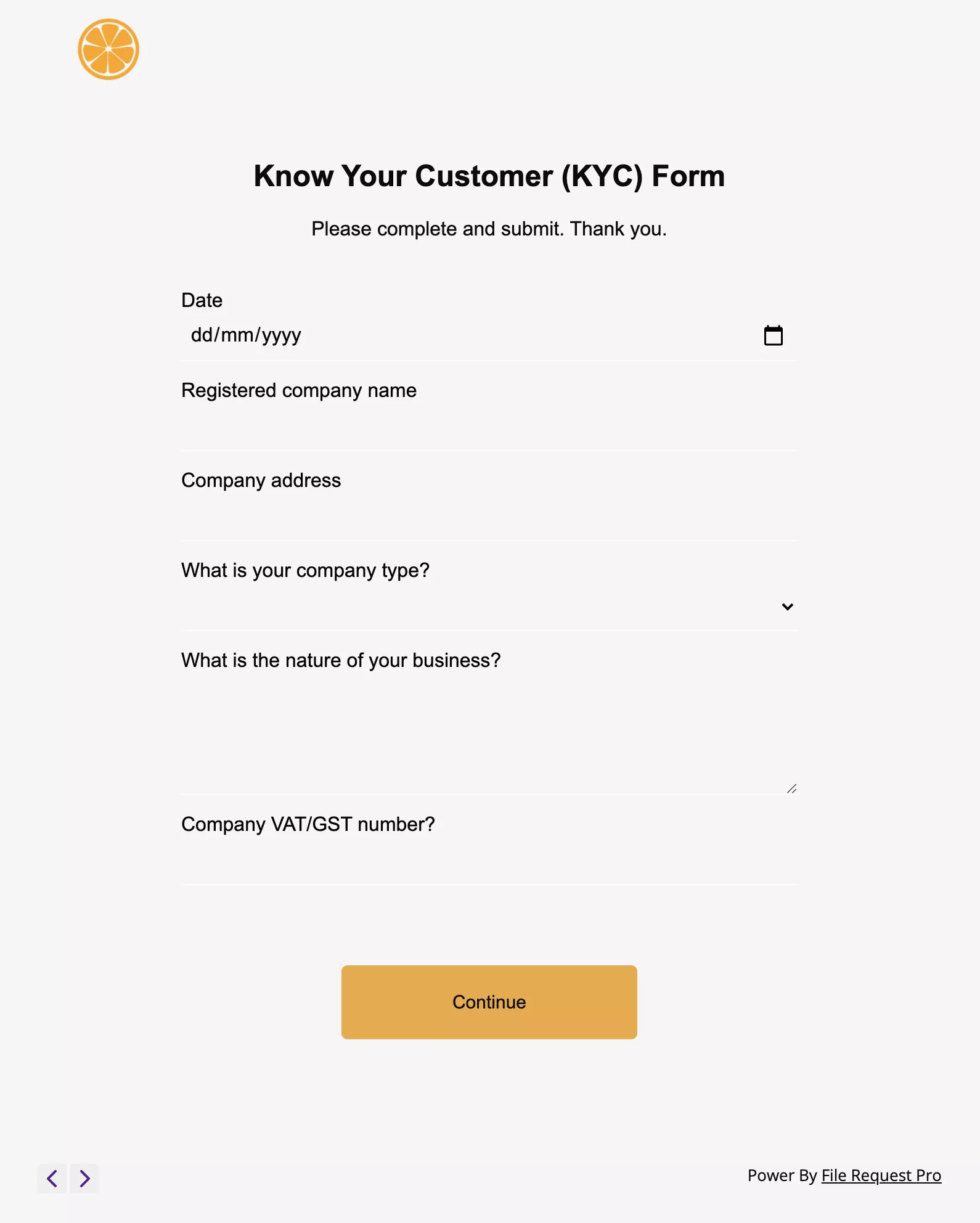

Working with businesses (B2B).

- Registered company name.

- Address.

- Type/status.

- Nature of business.

- Company reference number/VAT number/GST number.

- Company directors/partners/owners (and contact details/personal information for the aforementioned).

- Name of bank.

- Branch address.

- Account number/Swift code/IBAN.

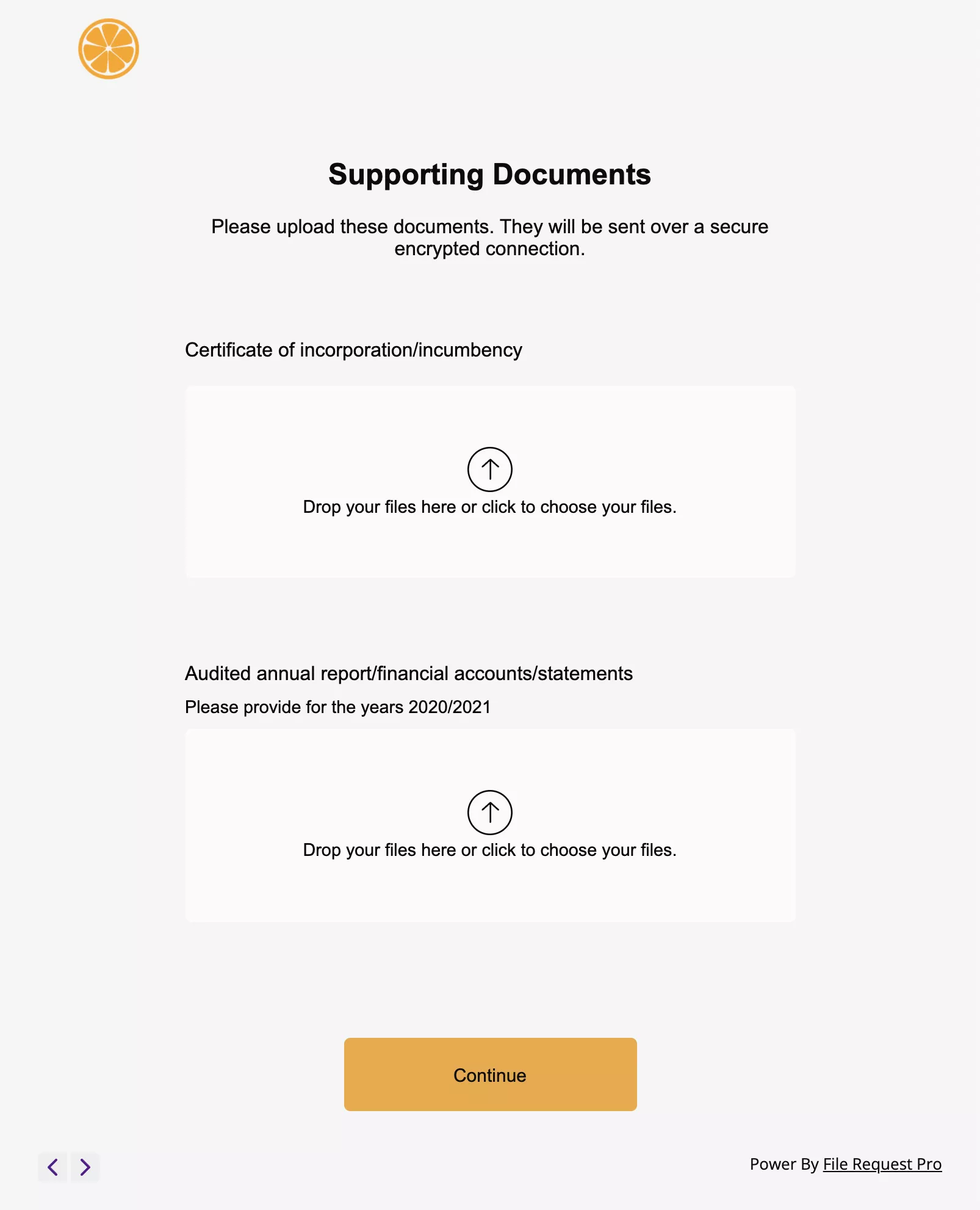

Supporting documents.

- Certificate of incorporation/incumbency/memorandum/articles of association.

- Audited annual reports/financial accounts/statements.

- Share Register / Ownership Structure Chart.

- Confirmation of company address.

- Confirmation of the identity of directors.

If you are working with other entities, like Trusts, then you will need to request specific information like the full name of the Trust, date of creation, country of establishment, nature, purpose, and objects of the Trust, and so on.

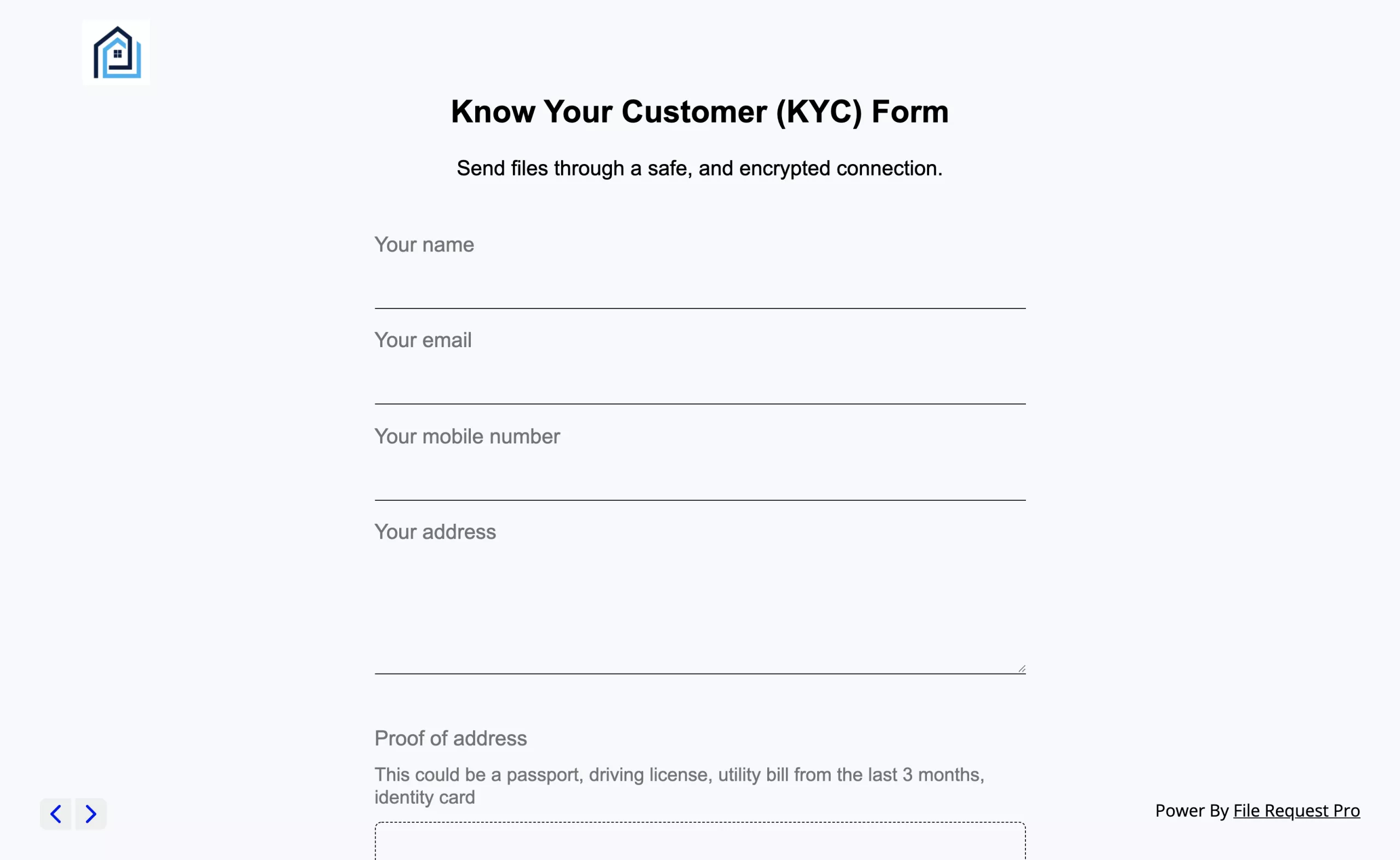

Working with individuals.

- Name.

- Address.

- Contact details.

Supporting documents.

- Proof of identity.

- Proof of address.

If someone else is acting on behalf of an individual, you will also need to identify the ‘beneficial owner’, as described by the UK government website:

As a general rule, the beneficial owner is the person who’s behind the customer and who owns or controls the customer, or it’s the person on whose behalf a transaction or activity is carried out.

Example from a know your customer (KYC) form.

These examples have been created using File Request Pro, which is lightweight document collection software.

Compliance vs Customer experience.

Although KYC checklists are essential for certain businesses, you do need to ensure that your customers don’t have a poor user experience.

If customer onboarding takes 2-4 months and countless back-and-forth emails, then the time to value for your customers is too long. Even if they stick out the process, they won’t be your biggest fans by the end of it, a situation which could affect their decisions in terms of giving you future business or recommendations.

Common mistakes include:

- Sending your customers digital KYC forms that look exactly like paper forms and are equally boring and hard to fill in.

- Requiring your customers to have an existing cloud account to upload documents.

- Asking customers to store yet more passwords or pin codes to send you documents.

Digital know your customer (KYC) forms.

If you are sending your customer’s digital forms then ensure the form is easy to fill in on any device for that specific customer.

Form layout.

- Make sure the form is responsive and works on any device.

- Give each question plenty of space so it is easy to read without peering at it.

- Use multi-page forms so you don’t over-face customers with lots of questions at once.

- Use headings and subheadings to make it easy for customers to understand what you need.

Form fields.

- Use conditional logic to only show customers questions that are relevant to them.

- Use dropdowns, for example, that show multiple options without taking up lots of space.

- Include upload questions that are clear and easy to use (drag and drop files).

Form user experience.

- Make sure the form auto-saves and has forward and back buttons so customers can make mistakes or come back to the form.

- Include clear help text or example content so your customer knows what you need from them.

- Specify what content you need ‘under the hood’ so customers can’t send you incorrect information – just make sure customers know what you need so they don’t get frustrated.

Collecting and organizing information from KYC forms.

In some ways, creating a form to gather key information and documents from your customers is the easy part of the process. What can be challenging – and is often given surprisingly little consideration – is where that information should be sent and how it should be organized.

It is vital that all information is not only sent to you through a secure, encrypted connection but also that it is correctly stored and organized. Too much reliance on the manual organization (downloading and re-uploading to somewhere else) may lead to mistakes and lost documents. This can turn into a security issue.

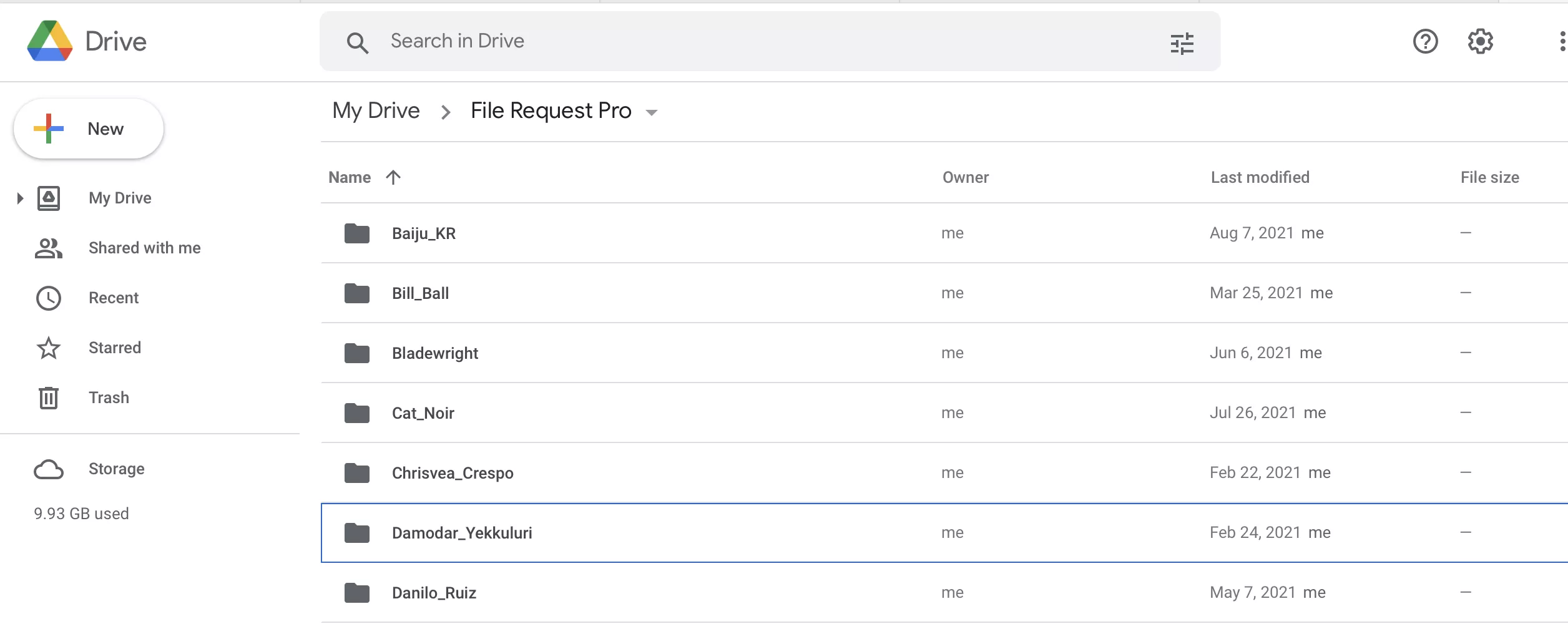

If possible, automatically send all customer content and documents directly to your cloud storage, already organized into folders – by customer name, or reference number, for example. This way you ensure that customers’ documents are kept secure, organized, and findable by all your team (with the correct permissions).

Automating your KYC strategy.

If know your customer (KYC) forms or checklists are something you have to send to all your customers, then it makes sense to automate as much of the process as possible. This will save you time, and also hopefully reduce the onboarding process from months to weeks.

Rather than replacing your entire onboarding process with bells and whistles software aimed at corporations, you can test out automating aspects of your KYC strategy with more lightweight (and less expensive) document collection software. This may not be sufficient for your needs, but with self-service free trials you can easily try them out and see.

Aspects of the process you can automate/repeat include:

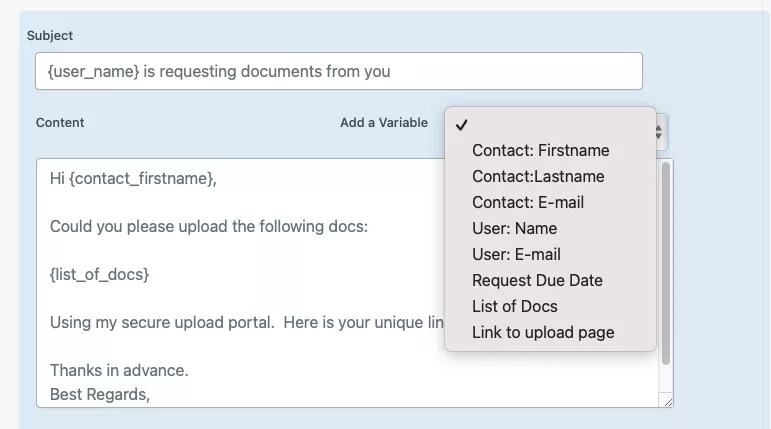

- ‘Smart’ reminder emails are sent out to encourage customers to submit content and documents by a certain date, or in a number of days.

- Automated file request emails and thank you emails.

- Automatically sending files to your cloud storage, organized into folders.

- Templates or duplicate KYC forms so you don’t have to keep creating them.

Create your KYC checklist with File Request Pro.

File Request Pro is lightweight document collection software that makes it easy for you to create branded KYC forms that you can send to your customers or embed in your website.

Create approachable multi-page forms that work on any device. Use conditional logic to only show customers questions that are relevant. Ask customers to drag and drop files without them needing to log in or have an account.

Content and files can be sent automatically to Google Drive, Microsoft OneDrive and SharePoint, and Dropbox. Use Zapier to connect File Request Pro to thousands of other apps.

We take security very seriously. You can read our security commitments here.

For more information visit our website or sign up for a free trial and create your own KYI form within 20 minutes.