A PBC list (Provided by Client list) is the document checklist an auditor sends to a client before an audit begins. It tells the client exactly which records, statements, and supporting documents they need to hand over — and by when.

A well-organized PBC list keeps the audit on schedule. A disorganized one — or worse, no list at all — creates weeks of back-and-forth, missed deadlines, and frustration on both sides. This guide covers what belongs on a PBC list for financial, tax, and compliance audits, provides a ready-to-use template you can copy today, and explains how to collect PBC documents from clients without chasing them through email.

What Is a PBC List?

A PBC list is a formal request for documents that an auditor sends to the client at the start of an engagement. The acronym stands for "Provided by Client," and the list functions as a checklist of everything the audit team needs to perform their work.

The list typically includes financial statements, reconciliations, contracts, board minutes, tax filings, and any other records relevant to the scope of the audit. Each item has a description, a due date, and often a status column so both sides can track what has been submitted and what remains outstanding.

PBC lists serve two purposes. For the auditor, they provide a systematic way to request and organize the evidence needed to support the audit opinion. For the client, they provide a clear roadmap of what to prepare — eliminating the guesswork that slows the process down.

Who Prepares the PBC List?

The audit team prepares the PBC list. Typically, the senior auditor or engagement manager drafts the list based on the scope of the engagement, the client's industry, the applicable auditing standards, and any issues identified in prior-year audits.

The list is then reviewed by the engagement partner before being sent to the client. For recurring engagements, the prior-year PBC list serves as a starting point — updated with new requests and cleaned of items that no longer apply.

On the client side, the controller, CFO, or accounting manager is usually responsible for coordinating the response. In smaller organizations, this may fall to the business owner or an office manager. Regardless of who handles it, one person should own the process to avoid duplicated effort and missed items.

When to Send a PBC List

Timing matters. Send the PBC list too late and the client scrambles to pull documents together, causing delays. Send it too early and it sits in someone's inbox, forgotten.

Most audit engagements involve two PBC lists:

- Planning PBC list. Sent four to six weeks before fieldwork begins. This shorter list covers the documents needed for audit planning — interim financial statements, organizational charts, board meeting minutes, and copies of new contracts or debt agreements. The planning list helps the auditor assess risk, set materiality, and design audit procedures.

- Fieldwork PBC list. Sent two to four weeks before fieldwork. This is the full list. It covers year-end financial statements, account reconciliations, supporting schedules, confirmations, and any additional documentation the auditor needs to test account balances and transactions.

For first-year engagements, add extra lead time. The client may not know what to expect, and the auditor may need to request documents that were previously handled by the predecessor firm.

PBC List Items by Audit Type

The specific documents on a PBC list depend on the type of audit. A financial statement audit requires different evidence than a tax audit or a compliance audit. Below are the core document categories and specific items for each type.

Financial statement audit

A financial statement audit examines whether an organization's financial statements are presented fairly in accordance with the applicable reporting framework (GAAP, IFRS, or another standard). The PBC list for this audit type is the most extensive.

General ledger and trial balance:

- Year-end adjusted trial balance

- General ledger detail for all accounts

- Journal entry listing for the audit period

- Chart of accounts

Financial statements and reconciliations:

- Draft financial statements (balance sheet, income statement, cash flow statement, statement of changes in equity)

- Bank reconciliations for all accounts as of year-end

- Accounts receivable aging schedule

- Accounts payable aging schedule

- Inventory listing and valuation schedules

- Fixed asset roll-forward (additions, disposals, depreciation)

- Prepaid expense schedules

- Accrued liabilities schedule

Revenue and expenses:

- Revenue breakdown by product line, segment, or customer

- Significant contracts with customers (new or amended)

- Sales cutoff analysis (last few days of the period and first few days of the next)

- Expense analysis by category with explanations for significant variances

Debt and equity:

- Loan agreements and amendments

- Debt amortization schedules

- Line of credit agreements and year-end balance confirmations

- Equity roll-forward (issuances, repurchases, dividends)

Corporate governance and legal:

- Board of directors meeting minutes

- Shareholder meeting minutes

- Legal correspondence and litigation summaries

- Insurance policies (general liability, D&O, property)

- Related party transaction disclosures

Tax audit

A tax audit examines whether an organization has accurately reported its tax obligations and complied with applicable tax laws. The PBC list focuses on income, deductions, credits, and supporting documentation.

- Federal and state tax returns for the audit period (and prior two years for comparison)

- Tax provision workpapers and effective tax rate reconciliation

- Estimated tax payment records

- Depreciation schedules (book vs. tax)

- Section 179 and bonus depreciation elections

- Payroll tax filings (Forms 941, 940, W-2 summaries, W-3)

- 1099 filings and supporting detail

- Sales and use tax returns and exemption certificates

- Property tax assessments and payments

- R&D tax credit documentation (if applicable)

- Charitable contribution receipts and substantiation

- Schedule of intercompany transactions and transfer pricing documentation

- Net operating loss carryforward schedules

- Correspondence with tax authorities (notices, assessments, settlements)

Compliance audit

A compliance audit evaluates whether an organization follows specific laws, regulations, or internal policies. Common examples include government grant audits (Single Audit / Uniform Guidance), SOX compliance, and industry-specific regulatory audits.

- Grant agreements and award letters

- Schedule of Expenditures of Federal Awards (SEFA)

- Grant-specific financial reports submitted to funding agencies

- Procurement policies and evidence of competitive bidding

- Subrecipient monitoring documentation

- Internal control policies and procedures manual

- Employee handbook and code of conduct

- Whistleblower and ethics hotline reports

- Regulatory filings and licenses

- Evidence of required training and certifications

- Data privacy and security policies (if applicable)

- Environmental compliance reports (if applicable)

- Corrective action plans from prior audit findings

PBC List Template

Below is a full PBC list template you can copy and adapt for your engagements. Customize it based on the client's size, industry, and audit scope. Remove items that do not apply and add any client-specific requests.

General information

- Organization chart (current)

- List of all entities, subsidiaries, and related parties

- Chart of accounts

- Description of significant accounting policies and any changes during the period

- Summary of significant events during the audit period (acquisitions, disposals, restructurings)

Financial statements and trial balance

- Year-end adjusted trial balance

- Draft financial statements (balance sheet, income statement, cash flow, equity)

- General ledger detail for all accounts

- Journal entry listing (including adjusting and closing entries)

- Consolidation workpapers (if applicable)

Cash and bank

- Bank reconciliations for all accounts (year-end)

- Bank statements for the last month of the period and first month of the next period

- Bank confirmation letters (or authorization to confirm directly with banks)

- Petty cash count sheet

- List of authorized signatories

Receivables

- Accounts receivable aging schedule (year-end)

- Allowance for doubtful accounts calculation and supporting analysis

- Write-offs during the period with approval documentation

- Subsequent cash receipts listing (first 30 days after year-end)

Inventory

- Inventory listing with quantities, unit costs, and total valuations

- Physical inventory count instructions and results

- Inventory obsolescence reserve analysis

- Standard cost variance analysis (if applicable)

Fixed assets

- Fixed asset register with additions, disposals, and depreciation for the period

- Capital expenditure authorization documentation for significant additions

- Lease agreements (both as lessee and lessor)

- Impairment analysis (if applicable)

Liabilities

- Accounts payable aging schedule (year-end)

- Accrued expense schedules with supporting calculations

- Loan agreements and amendments

- Debt amortization schedules and year-end balance confirmations

- Line of credit agreements with year-end outstanding balances

- Contingent liability analysis and legal letter

Revenue and expenses

- Revenue breakdown by product, service, segment, or geography

- Significant customer contracts (new, amended, or terminated)

- Revenue recognition policy documentation

- Significant or unusual expense items with explanations

- Variance analysis (actual vs. budget and actual vs. prior year)

Payroll and benefits

- Payroll register summary by month

- Payroll tax filings (quarterly and annual)

- Employee benefit plan documents and contribution schedules

- Stock compensation plan details and grant schedules (if applicable)

Tax

- Federal and state income tax returns for the period

- Tax provision workpapers

- Estimated tax payments schedule

- Deferred tax asset and liability schedules

- Correspondence with tax authorities

Corporate governance

- Board of directors meeting minutes

- Audit committee meeting minutes

- Shareholder meeting minutes

- Management representation letter (to be signed at audit completion)

- Attorney letter confirming pending or threatened litigation

- Insurance policy summaries

To put this template to work, save it as a spreadsheet with columns for item number, description, assigned to (client contact), due date, status (not started, in progress, submitted, reviewed), and auditor notes. This structure lets both sides track progress at a glance and quickly identify bottlenecks before they cause delays.

Three Elements of an Effective PBC List

The best PBC lists share three characteristics that separate them from generic document dumps.

1. Customization

Every PBC list should be tailored to the specific client. Sending a generic template full of irrelevant items wastes the client's time and signals that you do not understand their business. A manufacturing company needs inventory count procedures. A software company does not. A nonprofit receiving federal grants needs a SEFA. A privately held retailer does not.

Review the prior-year working papers, the engagement letter, and any planning notes before finalizing the list. Remove items that do not apply. Add items specific to the client's industry, structure, or current-year events.

2. Clear priorities and deadlines

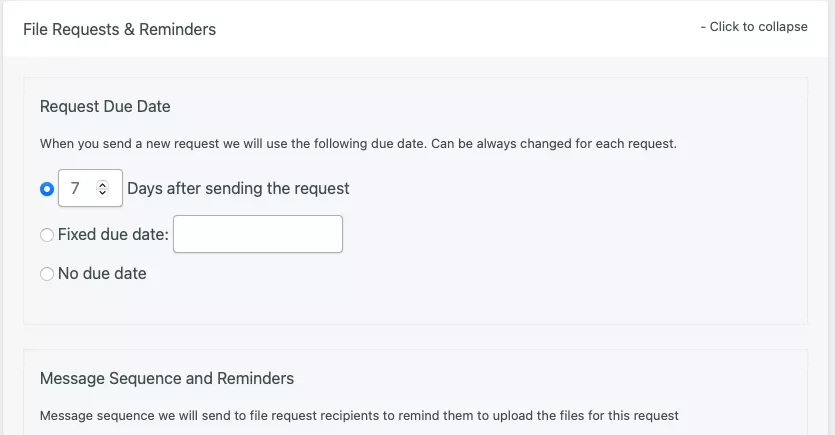

Not every document is needed at the same time. Group items by when they are needed — planning phase versus fieldwork phase — and assign specific due dates. Avoid vague language like "as soon as possible." Instead, use concrete dates: "Bank reconciliations due by March 15."

Prioritizing items also helps the client allocate their own team's time. If the audit team needs bank confirmations early to allow time for mailing and responses, say so. If certain schedules can wait until the second week of fieldwork, mark them accordingly.

3. The right delivery method

How you send and collect the PBC list matters as much as what is on it. Emailing a spreadsheet and hoping for organized responses creates confusion. Documents arrive in scattered email threads, file names are inconsistent, and tracking what has been received requires manual effort.

A better approach is using a structured document collection tool that gives the client a clear checklist, lets them upload files against specific line items, and automatically organizes submissions. More on this in the next section.

How to Collect PBC Documents from Clients

The PBC list is only as useful as the process behind it. You can create the most thorough checklist in the world, but if clients cannot figure out how to get you the documents — or if you spend hours sorting through email attachments and renaming files — the list has not done its job.

Here are the most common methods audit teams use to collect PBC items, along with the tradeoffs of each.

Email and spreadsheets

The traditional approach: send an Excel PBC list by email, and the client returns documents as email attachments. The auditor manually matches each attachment to the corresponding line item and updates the tracking spreadsheet.

This works for small engagements with a handful of items. It breaks down as the list grows. Documents arrive across multiple email threads from different people at the client. File names are inconsistent — "Q4 financials FINAL v2 (1).xlsx" is not unusual. The auditor spends time organizing files rather than auditing them.

Shared folders (Google Drive, Dropbox, SharePoint)

A step up from email. The auditor creates a folder structure that mirrors the PBC list and shares it with the client. The client uploads documents into the corresponding folders.

This is more organized than email, but it has limitations. Both parties need accounts on the same platform. There is no built-in way to track which items have been submitted and which are still missing. Clients may upload files into the wrong folder or overwrite existing documents. And there is no automated reminder system — when a client goes quiet, the auditor still has to follow up manually.

Dedicated document collection tools

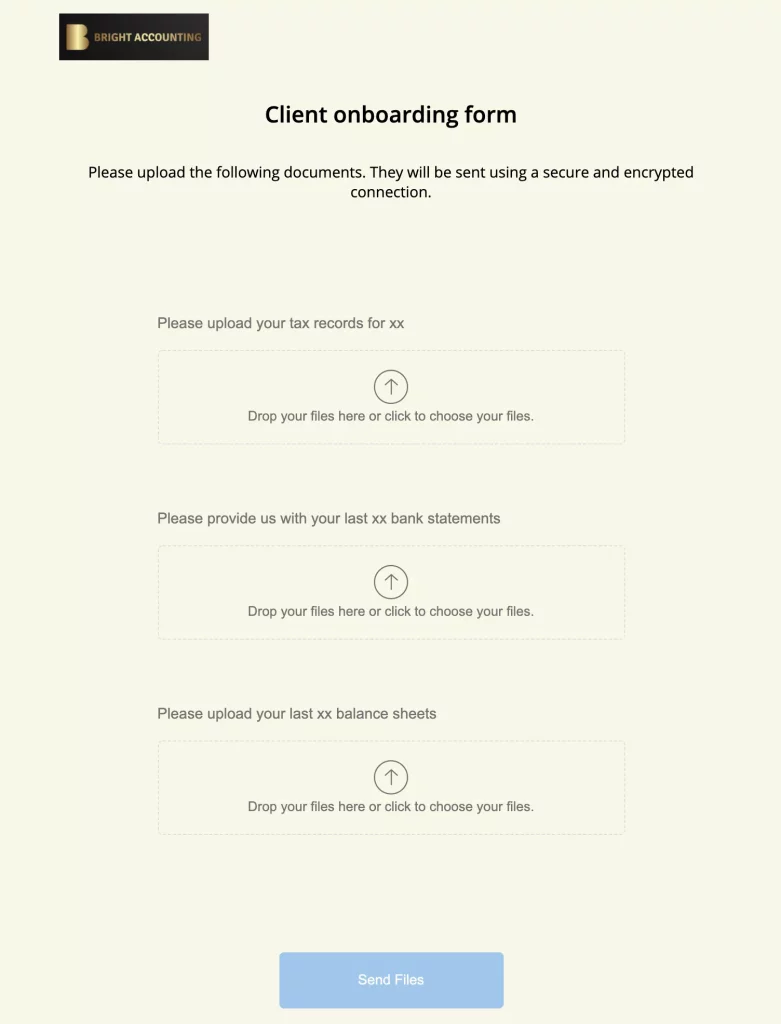

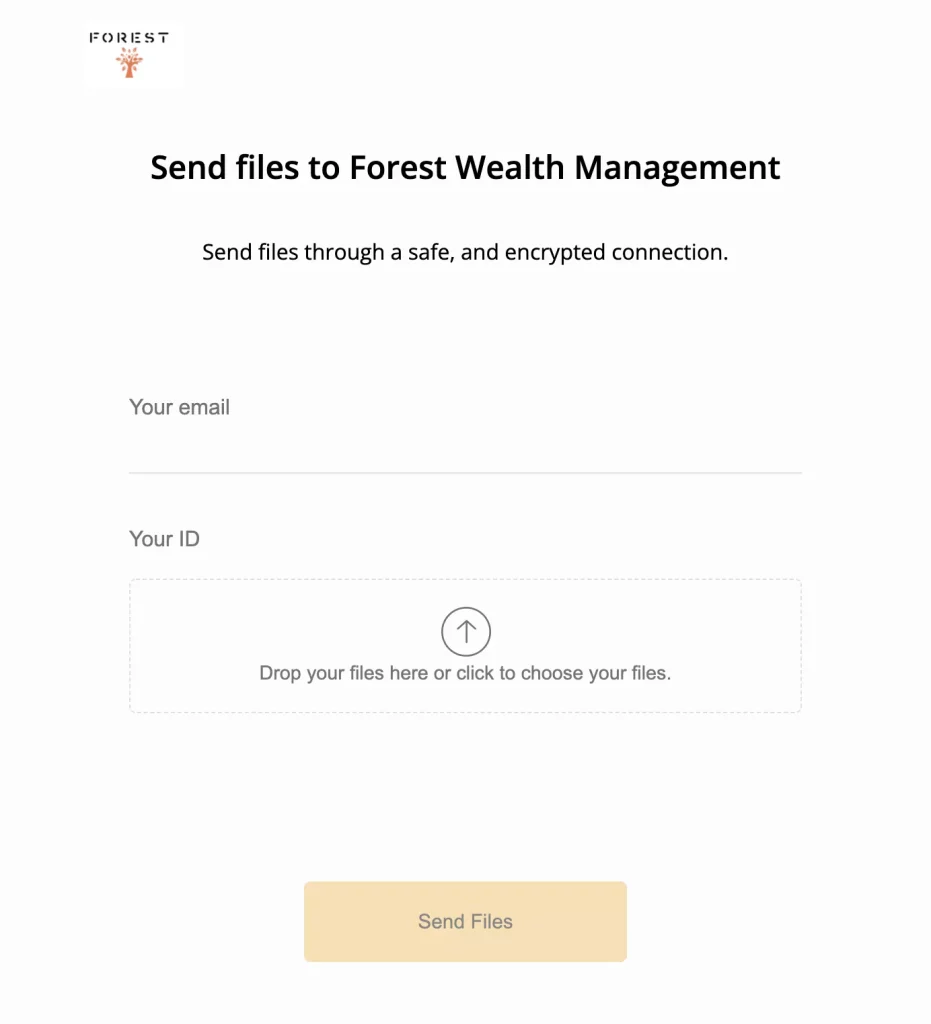

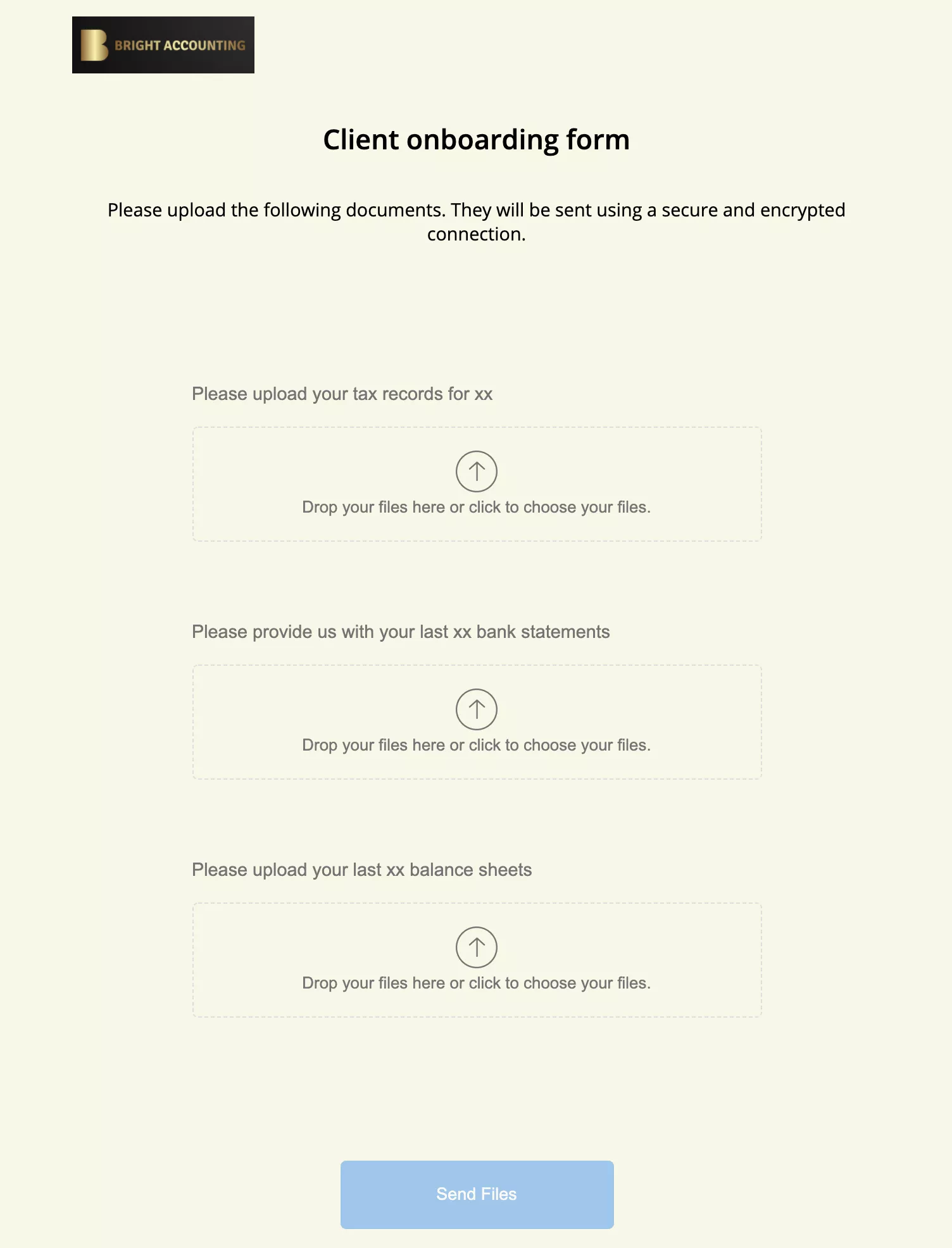

Purpose-built file collection software solves the problems that email and shared folders create. The auditor builds a branded upload page that mirrors the PBC list, with a specific upload zone for each requested item. The client sees a clear checklist, uploads files against each line item, and the tool handles the organization automatically.

File Request Pro is designed for exactly this workflow. You create a file request page with each PBC item listed as a separate upload field — bank reconciliations, trial balance, board minutes, and so on. Share the link with your client, and they work through the list at their own pace, uploading documents as they gather them.

Uploaded files route directly to your cloud storage — Google Drive, Dropbox, OneDrive, or SharePoint — organized into folders automatically. You do not need to download attachments, rename files, or sort documents manually.

The built-in reminder system follows up with clients who have not completed their uploads. Reminders are automatic and adapt to the client's progress, so you are not sending generic "please submit your documents" emails to someone who has already uploaded 90% of what you need.

Clients do not need to create an account or learn new software. The experience feels more like filling out an online form than navigating a complex portal. This matters — clients who find the process straightforward are far more likely to complete their submissions on time, which keeps your audit on schedule.

Security considerations

PBC documents contain sensitive financial data — bank account numbers, tax identification numbers, revenue figures, and legal correspondence. Whatever method you use to collect these documents, security is non-negotiable.

Email is the weakest option. Standard email is not encrypted end-to-end, and attachments sit in inboxes indefinitely. Shared folders are better, but access controls require careful management — a single misconfigured sharing link can expose confidential data to anyone.

Dedicated collection tools typically offer encryption in transit and at rest, access controls, and audit trails showing who uploaded what and when. File Request Pro, for example, encrypts all user data at rest using AES 256-bit encryption and transfers files over encrypted connections.

Best Practices for Managing the PBC Process

Even with the right tools, the PBC process requires active management. These five practices help keep engagements on track and prevent last-minute scrambles.

Start with a kickoff meeting

Before sending the PBC list, hold a brief kickoff meeting with the client's accounting team. Walk through the list together, clarify any items that might be confusing, identify who is responsible for each category of documents, and confirm the timeline. Ten minutes of alignment upfront saves hours of back-and-forth later.

Assign a single point of contact

On the client side, one person should coordinate the PBC response. When multiple people upload documents without coordination, items get duplicated, outdated versions are submitted, and nobody has a complete picture of what has been provided. The designated contact does not need to gather every document personally — they need to track progress and ensure nothing falls through the cracks.

Set realistic deadlines

Send the PBC list at least four weeks before fieldwork. If you send it two days before the audit team arrives, you are setting everyone up for frustration. Build in buffer time for items that depend on third parties, such as bank confirmations and legal letters, which often take longer than the client expects.

Track status visually

Whether you use a spreadsheet or a collection tool, maintain a visible status tracker that both sides can reference. Categories like "not started," "in progress," "submitted," and "reviewed" make it immediately clear where things stand. Review the tracker in weekly status calls during the preparation period.

Follow up early and specifically

Do not wait until the deadline to check on progress. Follow up on outstanding items at the halfway mark and again a week before the due date. Be specific in your requests. "We still need the Q4 bank reconciliation for the operating account and the fixed asset roll-forward" gets results. "Please submit your remaining PBC items" does not.

What to Do When Clients Fall Behind

Even with clear deadlines and good communication, clients sometimes fall behind on PBC submissions. Here is how to handle it without derailing the engagement.

- Identify the bottleneck. Is the client short-staffed? Are they waiting on information from a third party? Is the list unclear? Understanding the root cause helps you respond appropriately.

- Reprioritize. If you cannot get everything on time, ask the client to focus on the items the audit team needs first. Bank reconciliations and the trial balance are typically needed before supporting schedules and corporate governance documents.

- Adjust the fieldwork schedule. If delays are significant, consider pushing back the start of fieldwork rather than starting with incomplete documentation. An audit built on partial information leads to more requests later and a longer overall engagement.

- Document the delays. Keep a record of when items were requested, when they were due, and when they were received. This protects the audit firm if the engagement timeline or budget is affected and provides context for future planning.

Frequently Asked Questions

What does PBC stand for in auditing?

PBC stands for "Provided by Client." It refers to the list of documents, records, and information that an auditor requests from the client to perform the audit. The PBC list is sometimes called an audit request list, document request list, or information request list — they all refer to the same thing.

Who prepares the PBC list?

The audit team prepares the PBC list. The senior auditor or engagement manager typically drafts it based on the audit scope, the client's industry, and prior-year experience. The engagement partner reviews it before it is sent to the client. The client's role is to respond to the list by gathering and submitting the requested documents.

When should the PBC list be sent to the client?

Send the planning PBC list four to six weeks before fieldwork begins. Send the fieldwork PBC list two to four weeks before fieldwork. For first-year engagements, add extra time since the client may not be familiar with the process. The goal is to give clients enough time to gather documents without so much lead time that the request gets forgotten.

What format should a PBC list use?

Most PBC lists are maintained in Microsoft Excel or Google Sheets, with columns for item number, description, responsible party, due date, status, and notes. Some firms use dedicated audit management software or document collection tools that track PBC items alongside file uploads. The format matters less than having a clear structure that both the auditor and client can follow.

How do you track PBC list progress?

Use a status column in your PBC spreadsheet with categories such as "not started," "in progress," "submitted," and "reviewed." Update the tracker as documents come in and review it during regular status calls with the client. If you use a document collection tool like File Request Pro, progress tracking is built in — you can see which items have been uploaded and which are still outstanding without maintaining a separate spreadsheet.

What if a client does not submit PBC items on time?

Start by identifying the reason for the delay. Then reprioritize — ask the client to focus on the documents the audit team needs first. If the delay is significant, consider adjusting the fieldwork schedule rather than starting with incomplete documentation. Document all delays for engagement management purposes and to inform future timeline planning.

How should PBC documents be collected securely?

PBC documents contain sensitive financial information and should never be collected through unencrypted email. Secure options include shared cloud folders with proper access controls, encrypted file transfer, or dedicated document collection tools that offer encryption at rest and in transit. Whatever method you choose, ensure that access is limited to authorized personnel and that files are stored in compliance with your firm's data security policies.