Every real estate agent knows the first meeting with a buyer can go one of two ways. Either you walk out with a clear picture of what they want — budget, location, timeline, deal-breakers — or you spend the next three weeks showing properties that miss the mark.

A buyer questionnaire prevents the second scenario. It captures the details that matter before you start searching, so every property you show is a real contender. Below you'll find 50+ ready-to-use questions organized by category, plus specialized questions for different buyer types and practical advice on sending your questionnaire.

Why Use a Buyer Questionnaire?

You stop wasting showings. Without a questionnaire, agents rely on a quick phone conversation and a few assumptions. The result is showing a three-story colonial to a buyer who needs single-level living, or scheduling tours in a school district the client already ruled out.

You surface budget realities early. Money conversations are awkward in person. A questionnaire lets buyers share their budget range, pre-approval status, and down payment situation honestly and on their own terms.

You discover hidden priorities. A first-time buyer might not think to mention they need a home office. An investor won't always lead with their cap rate requirements. Structured questions pull out details that casual conversation misses.

You create a reference point. When a buyer says "I never said I wanted a two-car garage" in week four, you can point back to their questionnaire. Written answers prevent miscommunication throughout the process.

You look more professional. Buyers comparing agents notice when one sends a structured questionnaire while the other just asks "So, what are you looking for?" over coffee.

50+ Buyer Questionnaire Questions by Category

Not every question applies to every buyer. Pick the categories and questions that match each client's situation.

Contact Information and Background

- What is your full name (and the names of any co-buyers)?

- What is your preferred phone number and email address?

- How do you prefer to communicate — phone, email, or text?

- What are the best times to reach you?

- Are you currently renting or do you own your home?

- What is your primary reason for moving? — The "why" behind the purchase shapes every recommendation. Downsizing retirees and growing families need completely different properties.

Property Preferences

These questions define the search criteria and help you filter listings before scheduling a single showing.

- What type of property are you looking for — single-family home, condo, townhouse, or multi-family?

- Which neighborhoods or areas are you most interested in? — If they name five, ask them to rank by priority.

- Are there any areas you want to avoid?

- How many bedrooms do you need at minimum?

- How many bathrooms do you need at minimum?

- Do you need a home office or dedicated workspace?

- What is your preferred lot size or yard space?

- Do you need a garage? If so, how many cars?

- Do you prefer a specific architectural style?

- What is the minimum square footage you would consider?

- Do you prefer a single-story or multi-story layout? — Accessibility needs or small children can make this a firm requirement.

Financing and Budget

Money questions are the ones buyers most often dodge in conversation. A written questionnaire gives them space to answer honestly.

- What is your target price range? — Offer ranges (e.g., $300K–$400K) to make it easier.

- What is your absolute maximum budget? — The target range and the ceiling are different numbers.

- Have you been pre-approved for a mortgage? If so, for what amount?

- What type of financing are you planning — conventional, FHA, VA, USDA, or cash?

- How much do you have available for a down payment?

- Are you comfortable sharing your approximate credit score range? — Frame this as optional to respect privacy.

- Do you have an existing property to sell before purchasing? — A contingent buyer has a different timeline and negotiation position.

- Are there other financial obligations we should factor in? — Student loans, car payments, or other debts affect borrowing capacity.

- What monthly mortgage payment are you comfortable with? — Pre-approval amounts and comfort levels don't always match.

Timeline and Urgency

Timeline determines your search strategy. A buyer who needs to close in 45 days gets a different approach than someone casually browsing for six months.

- When would you ideally like to move into your new home?

- Is there a hard deadline driving your timeline? — Lease expiration, job start date, or school enrollment deadlines change how aggressively you search.

- How flexible is your timeline if the right property takes longer to find?

- When would you like to start actively viewing properties?

- Are you ready to make an offer if we find the right property quickly?

Lifestyle and Neighborhood

Properties exist within neighborhoods, and neighborhoods shape daily life. These questions help you match buyers to communities, not just buildings.

- Where do you work? What is your maximum acceptable commute?

- Do you have children or are you planning to? What ages?

- How important are school ratings and district boundaries?

- Do you have pets? What kind? — Dog owners need yards. HOA restrictions on pets can eliminate entire neighborhoods.

- What amenities do you want nearby? — Grocery stores, restaurants, gyms, parks, public transit.

- Do you prefer a rural, suburban, or urban setting?

- How important is walkability?

- Are there environmental or safety concerns that matter to you? — Flood zones, wildfire risk, crime rates.

Must-Haves vs. Nice-to-Haves

This is where you separate the non-negotiables from the wish list. Confusing the two leads to either endless searching or a purchase the buyer regrets.

- List your top three non-negotiable features. — Forces prioritization. If a buyer says "everything is a must-have," they haven't thought through tradeoffs yet.

- List three features that would be nice but aren't deal-breakers.

- Are there features that would cause you to walk away from a property no matter what?

- Are you open to a fixer-upper, or do you want move-in ready?

- Would you consider a property that needs cosmetic updates if the price is right?

- Are you interested in specific features like a pool, finished basement, or smart home technology?

Questions by Buyer Type

Add these specialized questions based on who you're working with.

First-Time Home Buyers

- How familiar are you with the home buying process from offer to closing?

- Have you spoken with a mortgage lender yet?

- Are you aware of first-time buyer programs or down payment assistance in our area?

- What concerns do you have about buying your first home? — Common fears include overpaying, unexpected repair costs, and being locked into a location.

- Do you have a real estate attorney, or would you like a referral?

- How long do you plan to live in this home? — A buyer planning to stay two years has different priorities than one buying a "forever home."

Real Estate Investors

- What is your investment strategy — buy and hold, fix and flip, or something else?

- How many investment properties do you currently own?

- What is your target cap rate or cash-on-cash return?

- Are you looking for turnkey rentals, value-add opportunities, or distressed properties?

- Do you plan to self-manage or hire a property management company?

- What is your timeline for deploying capital? — 1031 exchange deadlines create hard time constraints.

- Are you interested in multi-family properties? If so, how many units?

Luxury Buyers

- Are privacy and security features important to you? — Gated communities, security systems, private driveways.

- Do you require specific luxury amenities? — Wine cellar, home theater, tennis court, guest house.

- Will this be a primary residence, vacation home, or secondary residence?

- Do you have requirements for views, waterfront access, or acreage?

- Are you interested in new construction or custom-build opportunities?

Relocation Buyers

- Where are you relocating from? — Their previous market shapes price expectations.

- Is your relocation employer-driven? Does your company offer relocation assistance?

- When is your start date at the new location?

- Do you need temporary housing while you search?

- What do you know about the neighborhoods in this area?

- What lifestyle factors matter most in your new location? — Weather, outdoor recreation, cultural activities, proximity to family.

How to Send Your Buyer Questionnaire

The tool you choose affects completion rates. A questionnaire that sits unopened in a buyer's inbox doesn't help anyone.

Emailing a list of questions or attaching a Word document is simple, but it creates problems. Buyers reply inline, breaking formatting. They answer half the questions and forget the rest. For a quick three-question check-in, email works. For a full intake, it falls apart.

Google Forms or Typeform

Online form builders organize responses automatically and look more polished than email. The limitation: buyers can't upload supporting documents (pre-approval letters, proof of funds) alongside their answers. You end up collecting the questionnaire in one place and the documents in another.

A purpose-built file collection tool

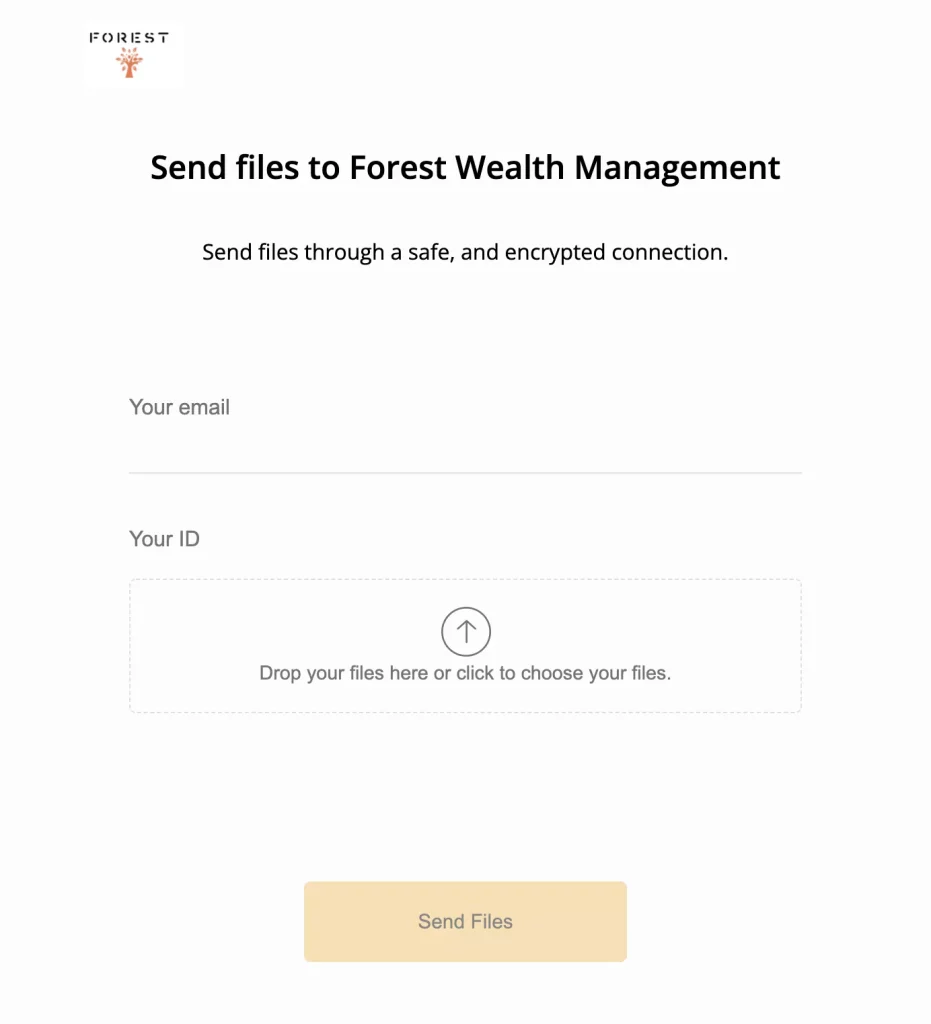

File Request Pro collects files and information from clients in one step. You combine questionnaire fields with file upload zones on a branded page — so a buyer answers intake questions and uploads their pre-approval letter and proof of funds in the same place.

Practical advantages for agents:

- Branded upload pages — Your logo, your colors. Buyers see your brokerage brand, not a generic form tool.

- Questions and documents together — Buyers answer questions and upload pre-approval letters, proof of funds, or ID in the same form.

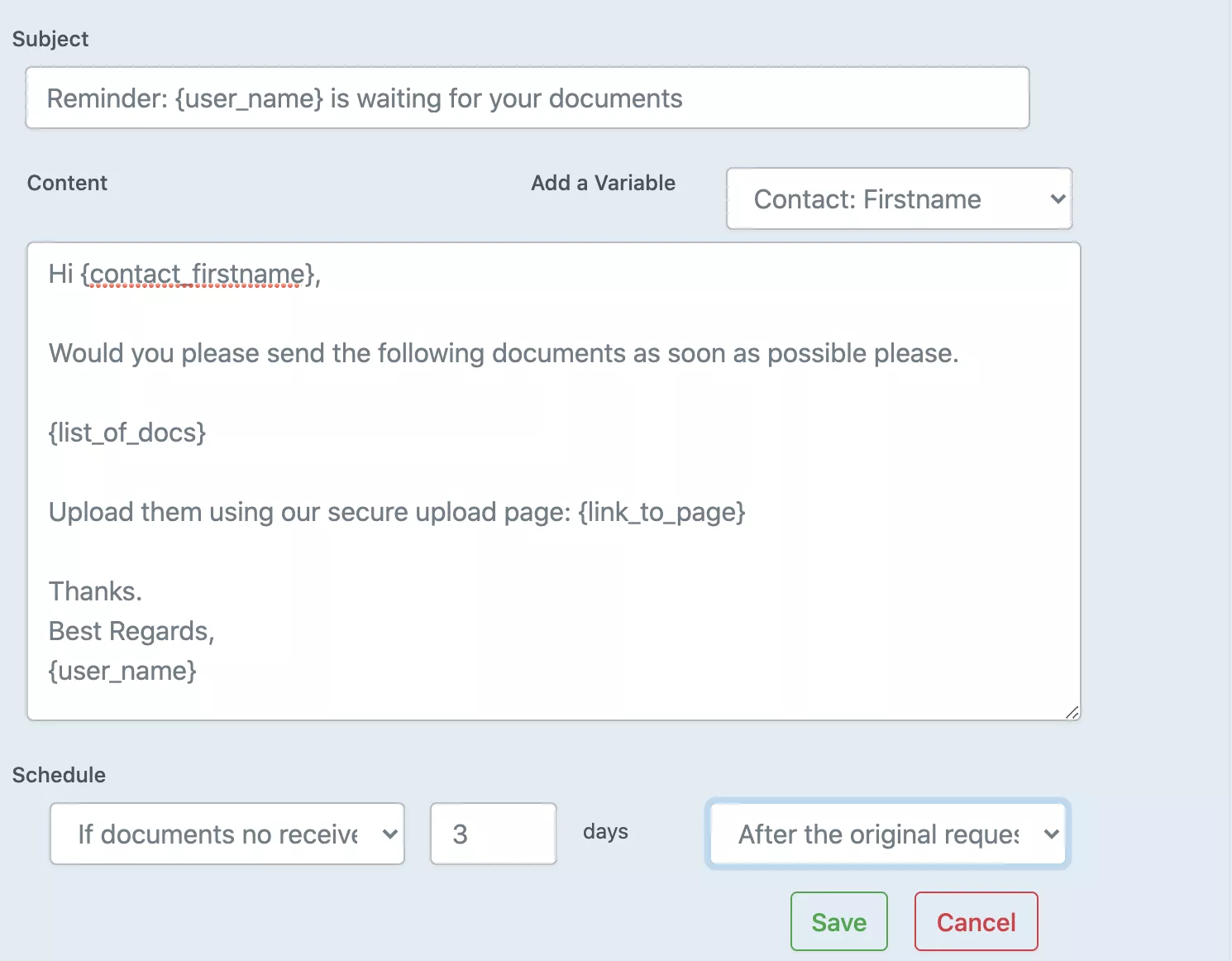

- Automated reminders — Reminder sequences nudge buyers who haven't completed the questionnaire, then stop automatically once they submit.

- Cloud storage sync — Responses and uploaded files go directly to Google Drive, OneDrive, or Dropbox, organized into client folders.

- No account required — Buyers click a link and start filling in. No login, no app download.

Tips for Better Questionnaire Responses

Send it early. The best time is right after the initial inquiry or first phone call, while the buyer is engaged.

Explain the purpose. A brief note — "Your answers help me find properties that match what you want, so we skip showings that miss the mark" — frames the questionnaire as a benefit to them.

Customize for each buyer. A first-time buyer doesn't need investor questions. A cash buyer doesn't need financing questions. Tailoring shows you're paying attention.

Set a deadline. "Please complete this by Thursday so I can have a curated property list ready for Saturday" works better than leaving it open-ended.

Frequently Asked Questions

How many questions should a buyer questionnaire include?

Aim for 20–30 questions for a typical buyer. Anything beyond 40 risks overwhelming them. Choose questions based on the buyer's type and situation rather than sending a universal list.

When is the best time to send a buyer questionnaire?

Right after the first meaningful contact — an inquiry call, a listing question, or a referral introduction. Waiting more than a day or two reduces completion rates.

What if a buyer refuses to fill out a questionnaire?

Use the questionnaire as your interview guide during the first meeting and fill it in yourself based on their answers. You still get the information — the format changes.

Should I include financing questions, or is that too personal?

Include them. Frame financing questions as practical and optional: "These help me find properties in the right price range and avoid surprises later." Buyers who aren't ready to share can skip those questions, and you revisit them in conversation.

Can I use the same questionnaire for buyers and sellers?

No. Sellers need to disclose property conditions and renovation history. Buyers need to communicate search criteria, financing status, and lifestyle preferences. Create separate questionnaires for each.

How do I handle a buyer who gives vague answers?

Vague answers usually mean the buyer hasn't made firm decisions yet. Use concrete comparisons in your meeting: "If I showed you two houses at the same price, one in Westside and one in Midtown, which would you lean toward?" That draws out real preferences better than open-ended questions.

Should I ask for pre-approval before sending the questionnaire?

Ask for pre-approval status within the questionnaire. Requiring pre-approval before sending the questionnaire adds friction and may lose you the lead — gather their information and guide them toward pre-approval as part of the intake process.

How do I keep questionnaire data organized across multiple buyers?

Use a tool that organizes responses automatically. File collection platforms like File Request Pro sync completed questionnaires and uploaded documents to cloud storage folders organized by client name — more reliable than saving email attachments manually, especially with 10+ active buyers.